The loan commitment is the beginning of the final stage in the home mortgage financing process. It is the lender’s conditional promise to offer a mortgage loan to a specific buyer for a specific property.

Many people confuse the loan commitment with the pre-approval or pre-qualification, so in this blog article we will help you understand exactly what is a loan commitment?

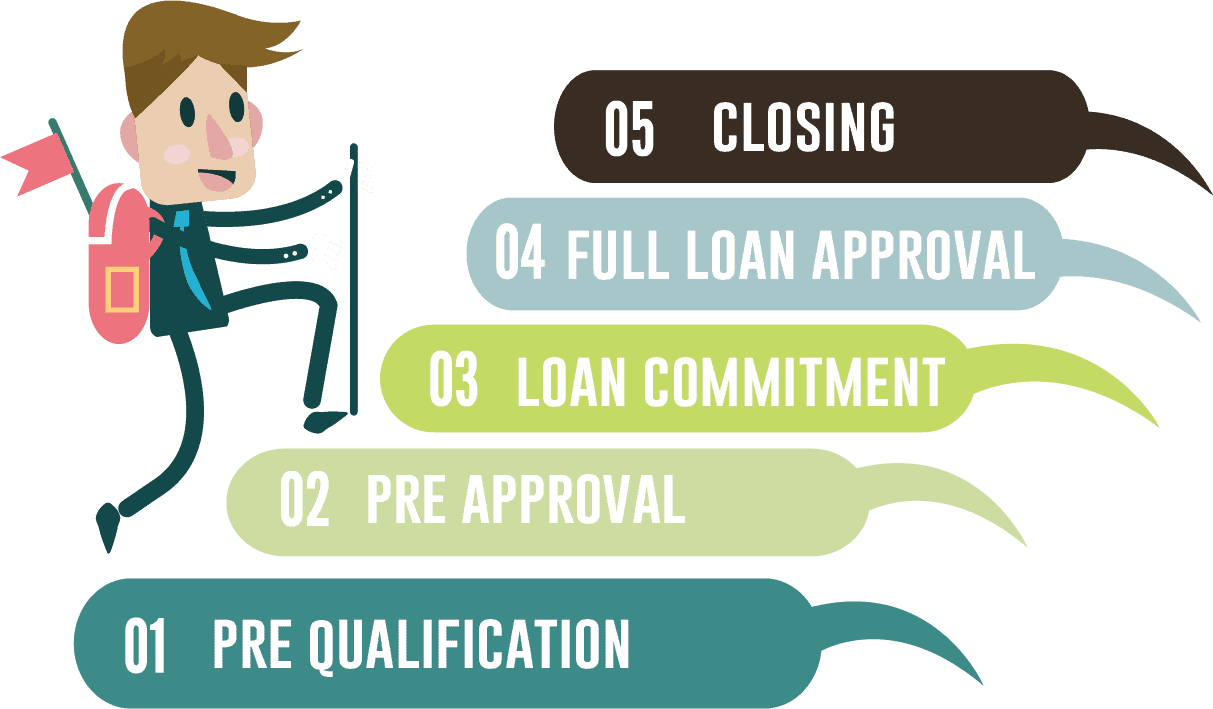

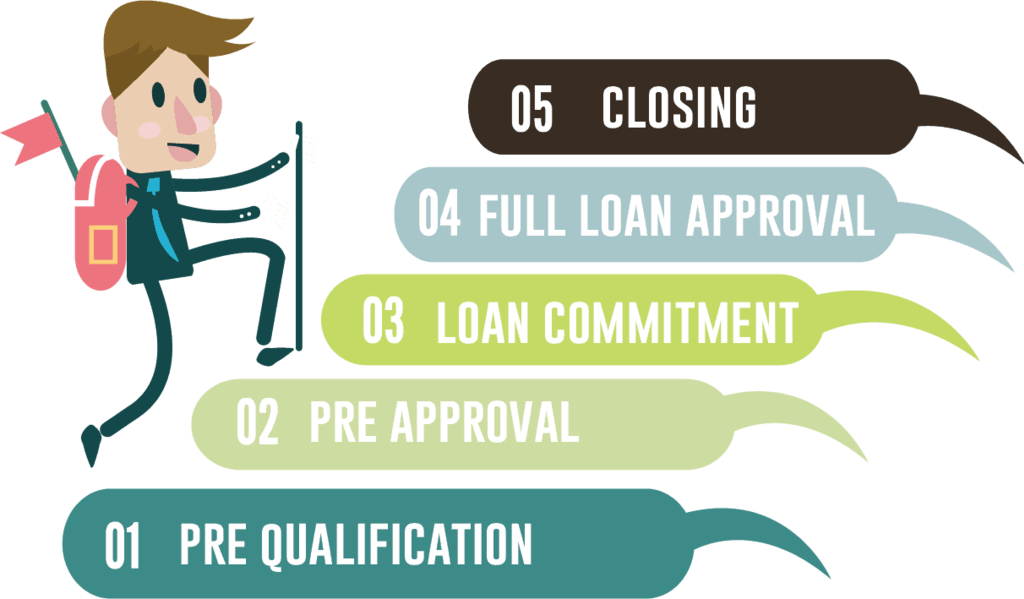

The Difference Between Pre-Qualification, Pre-Approval, and Loan Commitment

Many buyers are confused by the loan qualification process. The terms “pre-qualification”, “pre-approval”, and “loan commitment” all sound like they might mean the same thing. But they are, in fact, all different stages of the mortgage approval process. Buyers should progress through each stage in order.

Stage 1: Pre-Qualification

Pre-qualification usually takes place before a buyer makes a mortgage application. The process simply provides a guideline for how much money buyers can afford to spend on a home, given their financial situation. Buyers can get pre-qualified online in minutes since this step only looks at some basic financial information. Pre-qualification is helpful in determining a housing budget, buyers should get pre-qualified before they even begin looking at homes

This will ensure that they are looking in the correct price range. The lender may offer to provide you with a prequalification letter, this is good to have because it helps your Realtor know that you are serious and gives them an idea about what price range to start looking in. Most listing agents are ultimately going to want to see a stronger commitment from the lender before they accept your offer.

For more information on pre-qualification, visit our Mortgage Pre-Qualification Guide.

Stage 2: Pre-Approval

Pre-approval goes a step further; it looks at the buyers’ credit score, bank statements, pay stubs, and assesses the likelihood that they will repay the loan. The stronger your financial situation at this point the better the loan terms a lender will offer. Pre-Approval is especially important in a competitive market where sellers may see more cash offers.

Pre-approval requires a credit check by a lender.

This stage should be completed before making an offer on a house. Offers from pre-approved buyers are stronger than offers from buyers who are only pre-qualified. Pre-approval demonstrates to the seller that the buyer is serious and most likely will be able to obtain financing to close the deal. Again, sellers do not want to take their house off the market unless they are fairly certain the transaction will be completed.

If you’d like more information on pre-approval, read our article, What is the Difference Between Pre-Qualification and Pre-Approval?

Stage 3: Loan Commitment

Once the buyer’s offer on a home is accepted by the seller, the buyer can request loan estimates from multiple lenders to find the lender offering the best terms.

And once a lender has been selected, the lender will review the file and provide a loan commitment letter confirming their intention to provide funding for the purchase, as long as both the property and the buyer’s financials meet the lender’s criteria.

You’ll notice that, unlike the pre-qualification and pre-approval, which each evaluate only the buyer, the loan commitment conditions require an evaluation of both the buyer and their chosen property.

To satisfy the condition relating to the buyer’s financials, the buyer must provide up-to-date documentation of their financial position, source(s) of income, and creditworthiness.

To satisfy the condition relating to the property, the property must appraise for the purchase price (or greater) and may need to pass a physical inspection.

What is a Loan Commitment?

Two conditions must be met before a loan commitment can become a full approval:

- Condition #1: The property must meet the standards of the lender in terms of value and condition. Lenders need to be sure the property is a reasonably sound investment because they could acquire the property if the buyer were to default on the loan.

- Condition #2: The buyer’s finances must meet underwriting guidelines of the lender. The lender needs to evaluate the buyer’s ability to repay the loan.This typically means confirming that the buyer’s financial situation has not changed since the pre-approval was granted. For example:

- Major purchases, especially those that increase the buyer’s total debt, negatively impact the buyer’s ability to repay the loan.

- Missing a payment negatively impacts the buyer’s creditworthiness.

- A change in income, perhaps because of a change in employment, alters the buyer’s original debt to income ratios.

Both REALTORS® and lenders will advise home buyers to avoid making any major purchases, job changes or late payments in between the time they make loan application and close on a house. Unfortunately, buyers often underestimate the seriousness of this warning. They see loan commitment as a green light to move on with their lives and go out and make purchases to prepare for that new life. This can leave them with a bunch of new stuff and no place to keep it.

The loan commitment is not some legally binding guarantee of a mortgage. It’s simply a signal from the lender to all parties in the transaction that the deal is on track and can proceed to the final stage of the mortgage process as planned. This is a reassurance to the seller who has taken their home off the market (and off the radar of other potential buyers) in anticipation of closing this sale. It is also helpful to the Realtors® who are investing time and energy into closing the transaction smoothly.

The loan commitment comes in the form of a letter. This letter outlines:

- The type of mortgage being obtained

- The amount of money being borrowed

- The terms or length of the repayment period

- The agreed-upon interest rate

Sample Loan Commitment Letter:

| Attention:

[Real Estate Agent] This letter is to inform you that I have reviewed:

Based on my assessment of these items, [Client Name] has been approved for a [Type of Home Loan] to purchase the subject property at the offer price of [$$$,000] and terms listed in the purchase contract.

I am looking forward to working with you towards the successful close of this transaction. You can trust that my team will keep you informed every step of the way. If you have any questions or need additional information, please feel free to contact me. Sincerely, |

The Buying Process Leading Up to the Loan Commitment

To clarify how the pre-qualification, pre-approval, and loan commitment all fit into the big picture, here is a look at the steps in the buying process leading up to the loan commitment:

- Buyers obtain pre-qualification so they know what price ranges to consider.

- Buyers start house-hunting.

- Buyers obtain pre-approval from a lender so they will able to make a strong offer on a house when the time comes.

- Buyers make an offer on a house (accompanied by the pre-approval letter).

- The offer is accepted, creating a purchase contract. The contract will outline dates and deadlines for contingencies, including a finance contingency for the buyer to obtain a home loan.

- The buyer sends the contract to all lenders they are considering for the home loan.

Within three days, each of the lenders to which the buyers applied will provide a loan estimate. - The buyers evaluate the loan estimates and choose the lender offering the best loan option for their situation.

From this point, the chosen loan officer can provide the Loan Commitment Letter and move the transaction into the final stage of the financing process, and finish processing the loan documents.

The Final Stage of the Financing Process

To reiterate, the loan commitment is conditional, so the loan commitment letter does not constitute official approval of the loan. Official approval can only be granted after the two conditions are met.

This final stage of the financing process includes evaluations to satisfy those two conditions:

- The buyer’s financials and creditworthiness will be thoroughly reviewed and documented.

- The chosen property will be appraised and its condition will be assessed.

Evaluating the Buyer

You’ll recall that buyers have already been pre-qualified and pre-approved by this point. But now is the time the lender will really scrutinize the buyer’s financials, credit, and source of income.

Buyers will need to provide complete documentation to confirm that they are financially stable and likely able to accept this new debt in addition to their existing debt payments and other living expenses. Buyers will need to provide their most recent financial documents to show that their financial position has not changed since their pre-approval.

This typically includes:

- account statements for all checking, saving, and investment accounts

- loan statements for any other current real estate owned by the buyer

- paycheck stubs showing year-to-date earnings

- most recent W-2 or I-9 tax forms

- statements for any new debts not yet listed on the credit report

The lender will also contact the buyer’s employer multiple times throughout the course of the loan application process to confirm that the buyer is still employed in good standing.

Failing to Meet the Buyer Condition of the Loan Commitment

It is possible for the buyer to fail to meet the condition of the loan commitment, thereby losing their loan commitment and even their pre-approval.

Lenders are looking for financially stable borrowers. And any disruption in a buyer’s finances during the loan application process can return the process to square one. Examples of behavior that could result in a revocation of the loan commitment and pre-approval include:

- Employment changes (a reduction in hours, a lay-off, or even accepting a new job)

- Late or missed payments on any debt, bill, or even rent

- Applying for another loan (perhaps an auto or a business loan)

- Legal issues, including marriage and divorce

- Closing a credit card account or settling an old debt (both of which alter your credit score)

- Making a large deposit or taking a large withdrawal (which will make the lender question where your money comes from and where it goes)

As a general rule, buyers should avoid doing anything that might change their financial position from the time pre-approval is granted until the close of escrow.

Massachusetts REALTOR® Bill Gassett has a great article that explains 14 things a home buyer can do to inadvertently get a mortgage pre-approval revoked.

Evaluating the Property

During the due diligence phase of the transaction, a more detailed evaluation of the property takes place. This should include an appraisal and often includes an inspection of the physical condition of the property.

The Appraisal

The lender will order an appraisal, to be paid for by the buyer, and a licensed appraiser will assess the chosen property. The appraiser’s assessment compares the chosen property to similar properties in the area that have recently sold, which allows the appraiser to determine the value of the chosen property under current market conditions. For more information on the appraisal process, check out What You Need to Know About Appraisals.

The property’s appraised value must be greater than, or equal to, the contracted purchase price to meet the condition of the loan commitment. This is mainly to protect the lender from loaning money on a property that doesn’t provide enough collateral for its loan.

Appraisers have also started to require inspections, or even repairs, of items that materially affect the value of the home (like the roof, heating, and cooling systems, or electrical work).

The Physical Condition

The physical condition of the property itself may also be considered during the property evaluation.

The standards for the physical condition of the property depend heavily on the type of loan for which the buyer has applied. This is because many home loans are packaged by type and sold on the secondary market to investors. Government-backed loans, such as FHA and VA loans, will have more stringent requirements than standard conventional loans. Learn more by reading Everything You Need to Know About Mortgages.

Regardless of loan type, the mortgage lender needs to factor in any health and safety issues including lead paint, water intrusion, and potential electrical hazards. Lenders are also concerned about any issues that could potentially damage the structure. Cracks in the foundation, termite infestations and defects in construction could all disqualify a property.

If material defects are identified, they may need to be repaired to satisfy the condition of the loan commitment. Afterward, the Appraiser may need to review any repairs or replacements and update the appraisal accordingly.

It should also be noted that not all home loans will cover all residential property types. For example, it can be difficult for manufactured homes (often called mobile homes) to qualify for a VA loan.

Failing to Meet the Property Condition of the Loan Commitment

It is possible for the property to fail to meet the condition of the loan commitment and to cause the buyer to lose their loan commitment.

The most common reasons properties fail to meet the conditions of the loan commitment include:

- Appraising for a value under the agreed-upon purchase price

- Existing health or safety issues

- Structural concerns

- A mismatch of the loan type with the property type

Final Approval of the Home Loan

Until then, buyers should remain exceedingly careful with their finances to ensure a smooth transition from pre-qualification, through pre-approval, through the loan commitment, and finally, to full approval of their loan.

It’s important to note that the commitment letter from a lender should have an expiration date. This means that if the loan doesn’t fund by that date, the deal is off and the lender doesn’t have to lend the money under the terms that were stated.