table of contents

FHA and the Dream of Homeownership

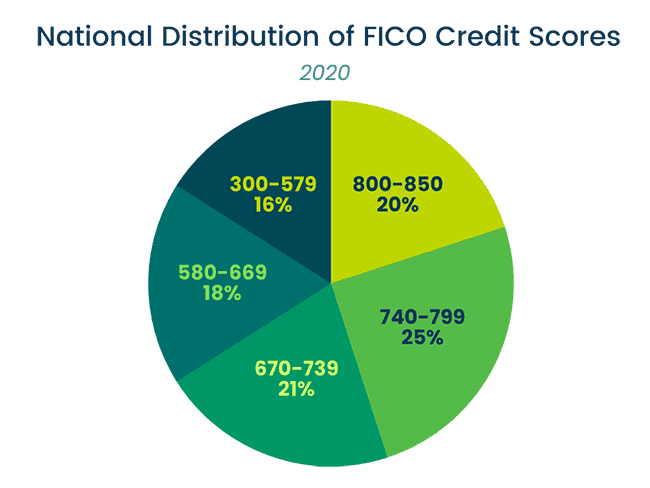

Are you dreaming of owning a home but need help saving for a down payment or have less-than-perfect credit? You’re not alone; the ideal minimum FICO score to obtain a conventional mortgage is 620. In contrast, approximately 33% of the US population has a FICO credit score below 620.

The good news is that the Federal Housing Administration (FHA) offers an excellent option for people with lower credit scores called an FHA home loan.

What is an FHA Home Loan?

An FHA mortgage is a low-down-payment home loan with more flexible credit guidelines than conventional mortgages. This makes the FHA loan ideal for people with less-than-perfect credit or who want to take on a smaller down payment. Here’s everything you need to know about getting an FHA home loan:

The Federal Housing Administration’s (FHA) mission is to promote homeownership in the United States by making it more accessible, especially for first-time home buyers. The FHA, or Federal Housing Administration, instituted a mortgage insurance program to accomplish this. FHA doesn’t loan money; they insure mortgage loans that an approved private FHA lender ultimately makes.

An FHA-insured mortgage loan provides a layer of protection for approved mortgage lenders. If an FHA borrower defaults on their loan, the FHA will pay the lender a predetermined amount to cover any loss. This makes FHA-insured loans more attractive for lenders because they are protected if a borrower fails to make payments and defaults on a loan.

FHA loans are also popular with mortgage lenders because of their flexible credit requirements. In addition, they allow more people to qualify for a loan, which can result in more successful loan applications and more money for lenders.

History of the FHA Home Loan

The Federal Housing Administration is a government agency that is part of the U.S. Department of Housing and Urban Development. Established in 1934, the FHA was part of President Franklin Roosevelt’s New Deal. Its primary purpose was to stimulate the housing market during the Great Depression by providing insurance to lenders against defaults on mortgage loans. Like the private mortgage insurance on a conventional loan, this insurance gave lenders greater confidence to lend to borrowers who may have otherwise been deemed too risky.

The FHA has since evolved to offer more flexible and affordable financing options to help even more people fulfill the dream of homeownership. Today, FHA home loans are a popular option for first-time homebuyers and those needing help securing traditional financing.

Advantages of FHA Home Loans

The minimum down payment required for a conventional home loan is 3%. However, this number can be higher, depending on credit score and debt-to-income ratio. Because of this, many people don’t qualify for the 3% down payment on a conventional loan.

The FHA loan has less restrictive requirements around credit score and debt-to-income ratios. This loan FHA also requires a lower down payment, which can be as low as 3.5% of the purchase price. These factors make it easier for people to get a loan that can’t meet most conventional lenders’ requirements.

Interest rate is another advantage of an FHA loan. Conventional loans look at credit scores when determining the interest rate a borrower pays. So that same borrower with difficulty qualifying for the 3% down payment will also have a higher interest rate and a higher monthly payment with a conventional loan.

Disadvantages of FHA Home Loans

While FHA home loans offer several benefits, there are also some disadvantages. Here are a few main drawbacks:

Upfront and Annual Mortgage Insurance Premiums: FHA loans require an upfront mortgage insurance premium (MIP) and an annual MIP. These costs can add up and increase the overall cost of the loan.

Property Eligibility Restrictions: FHA loans have property eligibility restrictions, meaning that the purchased home must meet specific standards for safety and livability. Homes that need significant repairs or renovations may not be eligible.

Loan Limitations: FHA loans limit the amount a buyer can borrow based on the property’s location. Loan limits may make looking at more expensive homes in some areas difficult.

Interest Rates: While FHA loans generally have a lower interest rate than conventional loans, they can still be higher than other government-backed loans, such as VA loans.

Paperwork Requirements: FHA loans may require more paperwork and documentation than other loans, which can be time-consuming and burdensome for some borrowers.

Principal Residence Restrictions: Only available for a principal residence, so you can’t use an FHA loan to buy a second home.

Overall, while FHA home loans offer many benefits, it’s essential to consider the potential drawbacks carefully before deciding if an FHA loan is the right choice for your needs.

FHA Eligibility Requirements

To be eligible for an FHA home loan, borrowers must meet specific minimum requirements. Here are the key eligibility requirements:

Credit Score: To qualify for an FHA-insured loan, borrowers must have a credit score of at least 580 for 3.5% down payments or 500+ for 10% down payments, though some lenders may require a score of 620+.

Employment and Income: Borrowers must have a steady employment history and an income sufficient to repay the mortgage.

Down Payment: Borrowers must make a minimum down payment of 3.5% of the purchase price. Some borrowers may qualify for a down payment as low as 0%.

Debt-to-Income Ratio: Borrowers must have a debt-to-income ratio that meets FHA guidelines, which means that their monthly debt payments (including the mortgage) cannot exceed a certain percentage of their monthly income.

Property Eligibility: The property you are purchasing must meet specific eligibility requirements, including being a primary residence, meeting particular safety and livability standards, and being within certain price limits.

It’s important to note that lenders may have their own additional requirements beyond these basic guidelines, so it’s always a good idea to check with your lender for their specific eligibility criteria.

FHA Loan Types

There are different types of FHA Loans, and each serves a different purpose and, in some cases, different payment options. Here’s a list:

Fixed-Rate Mortgage: This is the most common type of FHA loan, where the interest rate stays the same throughout the life of the loan. The loan term can range from 15 to 30-year terms.

Adjustable-Rate Mortgage (ARM): With an ARM, the interest rate can change over time based on market conditions. This adjustable-rate loan can result in lower initial payments but also carries the risk of higher payments in the future.

FHA 203(k) Rehab Loan: The FHA 203K loan is for borrowers who want to purchase a home that needs repairs or renovations. The loan amount includes funds for both the purchase price and the cost of repairs.

Energy Efficient Mortgage (EEM): This loan is designed for borrowers who want to purchase a home with energy-efficient upgrades, such as solar panels or energy-efficient appliances. The loan amount includes funds for both the purchase price and the cost of the upgrades.

Reverse Mortgage: This loan is available to homeowners who are 62 years or older and have significant home equity. It allows them to convert that equity into cash or a line of credit.

Each of these FHA loan types has its specific requirements and eligibility criteria, so it’s important to understand the differences when choosing the right loan for your needs.

How to Apply for an FHA Home Loan

You can only complete a “full loan application” once you have a specific property under contract. In other words, the lender wants to know what property they’re lending on. So, Before making a full loan application, you should get prequalified, or better yet, preapproved. This way, you’ll know if an FHA loan is right for you and have a good sense of whether you’ll qualify and the loan amount you qualify for. No matter what type of loan you’re trying to get, prequalification and preapproval are the wisest first steps when buying a home.

This simple step can save time and heartache, especially if you don’t qualify. A good lender will coach you on what to fix and how to fix it so you can qualify. Here are the general steps to apply for an FHA home loan:

Find an FHA-approved lender: The first step is to find a lender approved by the Federal Housing Administration to offer FHA loans. The lender will prequalify and preapprove you for a loan. They will help you put together the documentation and information you need when it’s time to make a full loan application. The basic list should include the following:

- Your full legal name

- Social Security Number

- Driver’s license or any other state-issued ID card

- Income information

- Employment history

Once you are “Pre-Approved,” you can begin looking at houses. You can proceed to a full loan application when you find a property and are under contract.

Making Loan Application: Most lenders offer the option of an online application. Others may want you to contact a loan officer to guide you through the application process in person or on the phone.

It’s important to know that interest rates and mortgage terms will differ from lender to lender. It would be best to talk to multiple lenders before deciding where to get your mortgage. 3 to 5 lenders is a reasonable number.

Many buyers worry that multiple credit inquiries will affect their credit scores. But, this is not the case if the applications are within 45 days of each other. These would be considered a single inquiry.

Each lender you apply with must give you a “Loan Estimate” this loan estimate allows you to compare the monthly loan payment, terms, and other costs associated with each loan. It’s wise to compare the estimates to determine which lender offers you the best deal.

Once you choose the lender you will ultimately work with, they will need a copy of the real estate contract, and your file will go into underwriting.

At this point, the lender will most likely ask for more documentation from you about things like employment, rental, history, expenses, pay stubs, etc. this is often a source of frustration for homebuyers.

Most of these additional requests are to fulfill guidelines so that the loan can be sold into the secondary market to an entity like Freddie Mac into the secondary mortgage market. In some cases, the lender may be adding their own underwriting requirements. This is known as an overlay, something the lender might do to feel more secure about making the loan. Either way, it is a necessary inconvenience.

The lender will order an appraisal to determine the property value because both the lender and the FHA want to know that you’re not overpaying for the home.

Once the loan is approved, you should receive something down as a closing disclosure. This document should be provided at least three business days before closing. This allows you to ensure everything about the loan is correct, there are no surprises, and to get answers to any questions, you might have before the closing.

It’s important to note that the specific steps in the application process can vary depending on the lender, so it’s always a good idea to check with your lender for their specific requirements.

FHA Mortgage Limits

There are limits to the amount that can be borrowed through an FHA loan, and the Federal Housing Administration sets these limits. These FHA loan limits ensure that loans remain accessible and affordable for borrowers in different parts of the country, regardless of differences in local housing markets.

The loan limits for FHA loans vary by location and are based on the median home prices in the area. FHA is projecting that the nationwide forward mortgage limit for a single-unit property in 2023 will be around $472,030 on the low end and $1,089,300 in high-cost areas.

It’s important to note that these loan limits apply to the base loan amount, excluding the down payment. Borrowers who need to borrow more than the FHA loan limit for their area may need to look into other types of financing, such as conventional loans.

Additionally, there are limits to the amount of upfront and annual mortgage insurance premiums that can be charged on FHA loans, which the Federal Housing Administration also sets. These premiums can add to the overall cost of the loan, so it’s essential to consider these costs when determining if an FHA loan is the right choice for your needs.

FHA and Housing Assistance Programs

The Federal Housing Administration (FHA) works nationwide with various housing assistance programs to provide additional financing options and loan programs to eligible borrowers. Many state and local housing agencies offer down payment assistance programs or other housing assistance to help low and moderate-income borrowers achieve homeownership.

FHA loans can be used with these programs to help make homeownership more affordable for eligible borrowers. In many cases, borrowers can use down payment assistance to cover the upfront costs of an FHA loan, such as the down payment and closing costs. Some housing assistance programs may also offer additional subsidies, such as interest rate reductions or principal mortgage reductions, to make the loan more affordable over the life of the loan.

The specific requirements and guidelines for these programs can vary depending on the program and location, so it’s important to research the options in your area and speak with an approved lender to determine if you’re eligible for any of these programs. FHA loans can be an excellent option for borrowers needing additional housing assistance to achieve their dream of homeownership.

CHAFA For Colorado Housing Assistance

One example of this here in Colorado is the “Colorado Housing and Finance Authority” (CHAFA). CHAFA is a statewide organization that provides financing for low and moderate-income borrowers who may need help securing traditional financing for their first home.

One of CHAFA’s financing options is the FHA CHAFA loan, an FHA-insured loan with additional down payment and closing cost assistance provided by CHAFA. The CHAFA loan can provide up to 3% of the loan amount in down payment assistance and up to 5% in closing cost assistance to eligible borrowers.

CHAFA helps Colorado residents achieve homeownership by providing financial assistance and making homeownership more accessible. Borrowers must meet CHAFA and FHAs requirements to be considered for the program.

This FHA and CHAFA collaboration is a good example of how state housing authorities nationwide can work with FHA to provide access to housing for eligible borrowers.

Drawbacks to Housing Assistance Programs

While housing assistance programs can significantly help low and moderate-income borrowers, there are some potential drawbacks to be aware of; here are a few to consider:

Eligibility Requirements: Housing assistance programs typically have specific eligibility requirements, such as income limits or location requirements. Borrowers who don’t meet these requirements may not be eligible for the program.

Limited Funding: Many housing assistance programs have limited funding available, and the funding may be on a first-come, first-served basis. This means eligible borrowers may miss out on the opportunity to receive assistance if the funds run out.

Extra Paperwork: Housing assistance programs may require additional paperwork and documentation beyond what is required for the loan itself. This can be time-consuming and may delay the closing process.

Repayment Requirements: Depending on the program, borrowers may be required to repay some or all of the assistance received. This can add to the overall cost of the loan and may make it less affordable over the long term.

Program Availability: Not all housing assistance programs are available in all areas. Borrowers in certain locations may have limited options for assistance.

Overall, while housing assistance programs can greatly help many borrowers, it’s important to carefully consider the potential drawbacks and weigh them against the benefits when deciding if these programs are the right choice for your needs.

Selling a Home, You Purchased With Housing Assistance

When it comes time to sell a house purchased through a housing assistance program, and there may be some issues to be aware of. Here are a few potential concerns to consider:

Resale Restrictions: Some housing assistance programs may include resale restrictions, limiting a borrower’s profit on the home sale. These restrictions can vary depending on the program and may limit the home’s potential resale value.

Payback Requirements: Some housing assistance programs require borrowers to pay back a portion of the assistance received when they sell the home. This can add to the overall cost of selling the home and may reduce the potential profit from the sale.

Program Transferability: In some cases, housing assistance programs may not be transferable to a new buyer. This can limit the pool of potential buyers and make the home more difficult to sell.

Affordability Requirements: If the home was purchased through a program that included affordability requirements, such as resale price restrictions or income limitations for future buyers, this could impact the resale value and potential pool of buyers.

Program Changes: Housing assistance programs can change over time, impacting the requirements and guidelines for selling a home. It’s crucial to stay up-to-date with any changes to the program that may impact the sale of the home.

Overall, while these issues can impact the sale of a home purchased through a housing assistance program, they can often be managed with careful planning and research. It’s important to understand the specific requirements and guidelines of the program and work with a knowledgeable real estate agent to navigate the sale process.

In Conclusion

FHA home loans provide an attractive option for many potential home buyers due to the low down payment requirements, competitive interest rates, and other benefits. These loans can benefit those with less-than-perfect credit or limited funds for a down payment, as they offer a safe and secure way to purchase a home. With an FHA loan, buyers have the flexibility to access more favorable loan terms and the assurance of mortgage insurance to help protect the lender if the borrower stops making their monthly mortgage payments and defaults on their loan.