8 Steps to

Buying a House

Buying a house doesn't need to be overwhelming. We have boiled the process down to the 8 simple steps to buying a house.

We'll find the home

you'll write the stories

The homebuying process can be both exciting and overwhelming. If you’re a first-time homebuyer you may have no idea where to start. If on the other hand, you have bought a home before, you may have felt underprepared or had a bad experience?

No matter your situation you likely have questions ranging from, When is the right time to buy a house? How much house can I afford? How does the home buying process begin?

We have boiled down the process to 8 simple steps. By educating yourself on this process, it will not only reduce your stress, but you will also be able to enjoy the journey along the way. These steps to buying a house will set you on the right path and assure you get the right home for the right price.

Full-service

Buying Experience

Buying a house doesn't have to be overwhelming. We've simplified the process into 8 easy steps.

How Much Can You Afford?

This is one of the first and most important questions to ask yourself.

Your Needs and Wants

Defining what you need versus what you want will ultimately help in the final selection of your home.

Tour Homes & Areas

It's time to jump in the car and see what is out there. This is often the most fun part of the process.

Processing

the Loan

Your mortgage lender will be invaluable during this stage. Remember, ask questions of your REALTOR® and Lender. That is what they are there for.

Inspection & Appraisal

The inspection and appraisal are critical stages of the process to make sure you are making a solid financial decision.

Title Processing

Title processing ensures all necessary checks confirm a clear title for the closing process, facilitating a smooth transaction.

Closing on Your Home

The closing process is the final stage before being handed the keys. The closer will make sure all of the paperwork is signed and in order.

Start with our

free Buyer's Guide

Springs Homes is happy to provide this home buying process guide and a little insight from our real estate experts to help ensure your home buying experience is a good one. As you go through this guide please remember that a good real estate agent can help you through every step of the process.

how to buy like a pro

Free Buyer's Guide

Comprehensive Real EstateBuyer's Guide

how to buy like a pro

Free Buyer's Guide

Comprehensive Real EstateBuyer's Guide

How Much Can You Afford?

This is one of the first and most important questions to ask yourself.

When considering purchasing a home you should ask yourself two things: First, how much can I afford to spend on a monthly mortgage and how much am I willing to spend on a monthly mortgage, based on your monthly budget?

Unless you are able to pay cash for a home, you’re going to need a mortgage loan. Since the home loan is typically the most complicated aspect of the home buying process this is the best place to start.

The mortgage lending process is complicated because of the various different loan types and long list of requirements and options associated with each one. Finding a qualified mortgage professional is a crucial first step. In order to find a good lender, you will want to ask your REALTOR® for a recommendation for a local lender. If you aren’t working with a REALTOR® yet, let us help! Otherwise, we suggest asking family and friends about their lenders.

We have a comprehensive Mortgage Pre-Qualification Guide. This guide walks you through the entire pre-qualification process in simple terms. You can also use our Colorado mortgage calculator to figure out how much your monthly mortgage payment will be.

Make sure you explore your options as far as lenders are concerned, you don’t have to commit to the first one you meet. It makes sense to talk to different lenders until you find one you are comfortable working with. Many people shop around looking for a lower interest rate, while mortgage interest rates are important, so is service.

It is also important to obtain something called a Loan Estimate from any lender you make a mortgage application with. The loan estimate provides the borrower with important information like the estimated interest rate, monthly mortgage payments, and total closing costs for the loan.

The lender can’t give you the full-blown loan estimate until you have a specific property under contract. This is because property taxes and homeowners insurance rates are going to be different from property to property. The lender should be able to give you a breakdown of their costs and fees though, this is sometimes called a fee sheet.

Once you’re pre-qualified you will move on to the pre-approval process. This is when you will become pre-approved for a loan on your future home! When you do finally get to make an offer on a house, you’re going to have to submit something called a lender letter. This letter is included with your offer. The purpose is to assure the sellers and the listing agent that you will have no problems obtaining a loan.

If this is your first home in Colorado, you may qualify for a Colorado First Time Home Buyer Program and your lender should be able to help you apply for these types of loan programs.

What about online lenders? Online lenders are more popular these days but maybe risky, especially for most first-time home buyers. Although there are reputable online lenders, you can’t beat a trusted local resource. If you are a first-time homebuyer or have a complicated loan, you should consider using someone locally.

Worried about your credit? A good lender can help you get on track with cleaning up bad credit or establishing good credit. If you want to know a little more about how bad credit plays into the process of buying a house check out our snippet Buying a House with Bad Credit.

What Every Loan Officer Wished Their Home Buyers Knew by: Kevin Vitali

Your Needs and Wants

Defining what you need versus what you want will ultimately help in the final selection of your home.

Once you figure out how much you should spend on a home you’ll make a list of your wants & needs, we call this a needs assessment. This is the step where you’ll create a list of things that are important to you like what neighborhood you want to live in, how many bedrooms, bathrooms, square footage, proximity to schools, etc… This list should start with the type of home you want. Are you interested in a condo or townhome, or is a single-family home the only option you will consider? You’ll also want to determine the absolute essentials. Absolute essentials are things like more bedrooms, more bathrooms, closer to work, or a specific school district. As you build this list you’ll move towards items that would be nice, but not essential, to have such as a good view, large closets, etc… Share your wants and needs list along with the information you learned during the pre-qualification process with your REALTOR®. Your REALTOR® can then begin doing their homework based on your finances and needs and wants. If you’re nervous about sharing your upper price range limit with your REALTOR® you are not alone. However, a good REALTOR® will respect your boundaries. If you’re not getting that vibe from your REALTOR® you should consider finding a new one.

Real Stories. Real Success.

What Our Clients Say

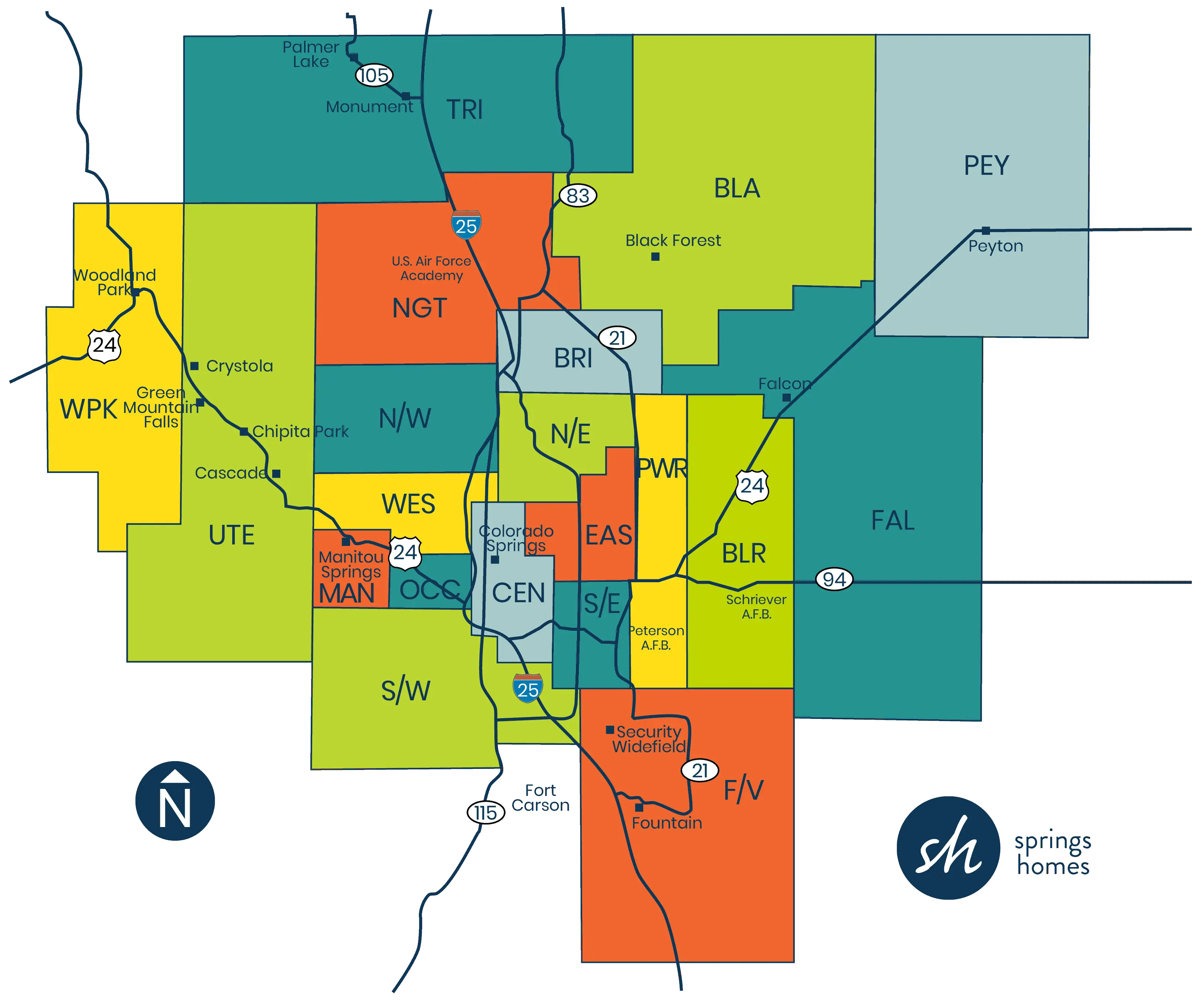

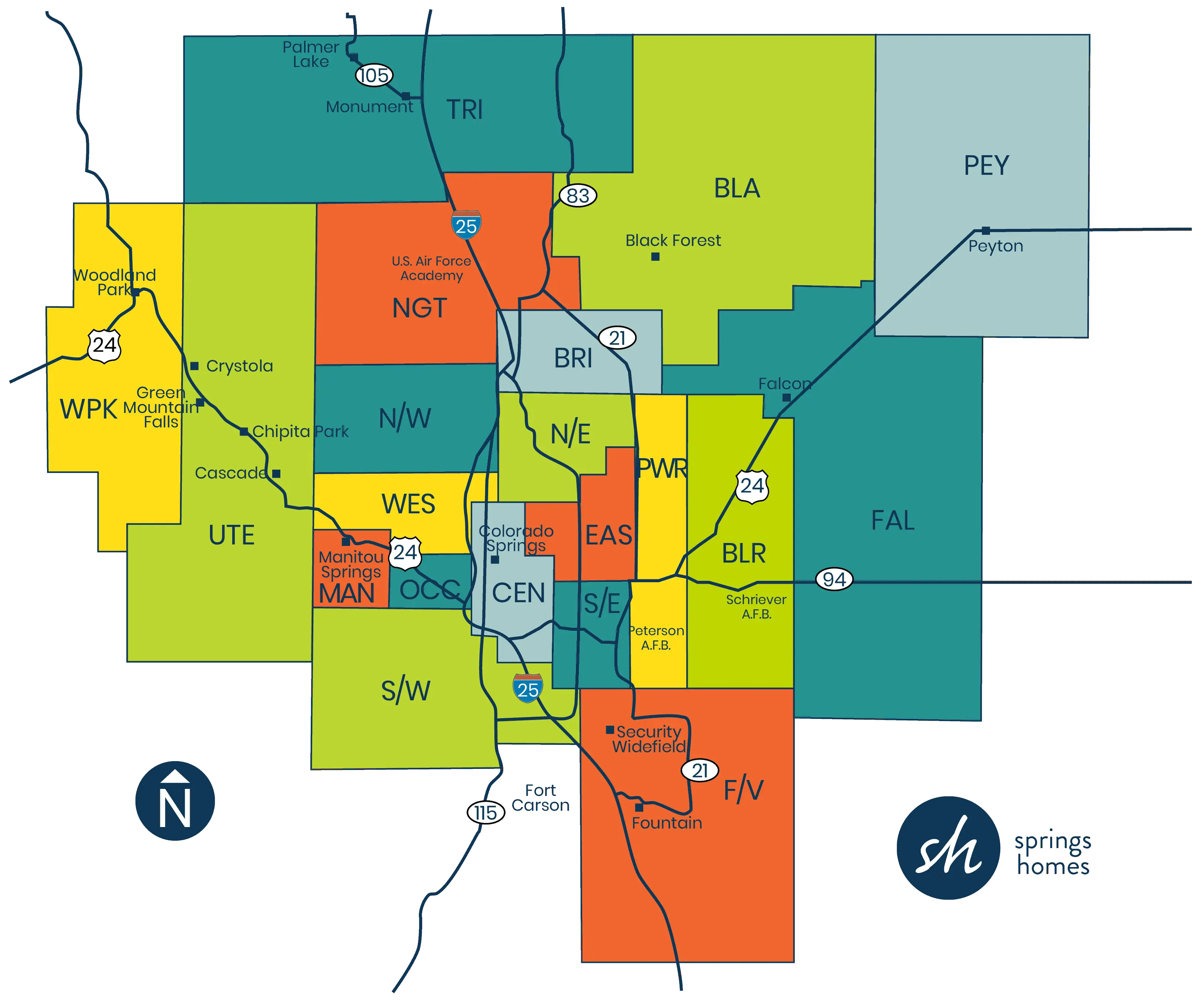

Tour Homes & Areas

It's time to jump in the car and see what is out there. This is often the most fun part of the process.

ou will also have to be extremely patient in this step, especially buying in a hot sellers market. Once you've looked at enough homes you'll get a strong sense of when a home is a good value or overpriced. This of course will give you a sense of when a home is priced correctly. In these cases, you'll need to move fast and swoop in to grab that home

Keep in mind that it may take a while to find something even close to what you’ve established on your needs & wants list. Depending on your needs, you may have to reevaluate this list as time goes on.

One thing that could be limiting you is choosing a neighborhood with a school district that outperforms others in the area - this usually drives up home prices. What to Look For When Searching For a Neighborhood Bill Gassett Interested in a fixer-upper? Keep in mind this could require more money or construction skills and knowledge and plenty of time. Let your REALTOR® know if you’re up for this type of adventure. How To Purchase And Renovate A Fixer-Upper Kyle Hiscock It could be wise for you to look at new construction. New homes will generally be more expensive but for many buyers, the sacrifice is worth it.

Your REALTOR® should know the new home communities and builders that are active in the areas you are interested in. Working with a REALTOR® on a new build is a good idea. A REALTOR® will be your advocate and liaison between you and the home builder and their representative.

Depending on the type of home you build you may need to change lenders. This is because not all lenders can provide construction financing. if you are buying a tract home in a subdivision the Builder will most likely want you to use their lender. If on the other hand you're building a custom home you're going to need to arrange financing. Here's a great article about how new construction loans work. It's also good to know that both VA and FHA offer construction loans as well.

Wondering about the terms short sale and foreclosure properties? In the current market, there are not many options as far as these go but you can read about them here: the difference between a short sale and a foreclosure.

At the end of the day, a great real estate agent is your best resource for finding hidden gems

Make an Offer on a Home

Now it is time to put pen to paper and make this home yours.

Your REALTOR® should produce something called a CMA, this stands for comparative market analysis. This analysis looks at similar homes in the immediate area that have sold in the last 6 months. Your REALTOR® will be looking for exact matches; properties that are exactly like the one you are considering.

This is important information to have, especially if you are buying a home in a "Sellers Market". This is nothing more than analysis to help you with the offer price for your home purchase.

Next, you and your REALTOR® will use this information to come up with the most well-informed offer you can make.

Before your REALTOR® actually writes the offer, there are three things they will consider:

• Terms: Are they willing to take your type of loan? Sometimes a home will not qualify for federal housing administration FHA or VA loans.

• Closing Date: When do you want to close? A lot of this will depend on when you can get the inspections and appraisal completed.

• Seller Concessions: Are you asking the seller for things like closing costs, inclusions, exclusions, etc?

A simple phone call at this point from your buyer's agent to the seller's agent to ask about the home seller's priorities is a good idea. The assumption is often that the highest purchase price wins, but this isn't always the case. The homeowner's financial situation and other priorities may be more important. It's not uncommon to see a home sell at a lower sales price in lieu of a preferred occupancy date, or other conditions.

This is a good time to touch base with the lender and give them a heads up that you are getting ready to make an offer on a property. This is when your REALTOR® will request the lender letter.

Next, you'll produce the earnest money deposit funds. The earnest money is your way of showing that you are serious about this transaction. If you don't follow through with the terms of the purchase agreement, the earnest money could be the seller's for keeps.

When your REALTOR® writes the offer, there will be a number of real estate contingencies in place in order to protect you from losing your earnest money while you are doing your inspections and getting your loan finalized. Conscientious REALTORS® and homebuyers don't tend to lose earnest money, it can happen though if you back out at the last minute.

Once your offer is accepted, the “Due Diligence” period begins. This means scheduling and performing inspections, reviewing covenants and title work, and a big list of other items.

Congratulations! You’ve completed another one of the steps to buying a house, you are one step closer to owning a home!

Processing the Loan

Your mortgage lender will be invaluable during this stage. Remember, ask questions of your REALTOR® and Lender. That is what they are there for.

Your offer has been accepted and you are now officially under contract on a home. The first thing you're going to want to do is to get a copy of your contract to the lender you have chosen.

Once you’ve submitted a full loan application and a contract, the lender has 3-days to get you a loan estimate. The loan estimate is a document the lender is required to give you after you have applied for a loan. This document breaks down the true cost of the mortgage loan.

The next phase of the loan process is underwriting. This is where a lender assesses whether or not they will assume the risk of your mortgage. They will likely ask for more documentation to prove they are confident you will pay back your loan.

The next phase of the loan process s underwriting. This is where a lender assesses whether or not they will assume the risk of your mortgage. They will likely ask for more documentation to prove they are confident you will pay back your loan. One of the final requirements of obtaining full loan commitment is the inspection and appraisal. Don’t forget, if you have a good REALTOR® they will be happy to explain everything throughout this process. You can read about this next. Everything You Need to Know About Mortgages

Inspection & Appraisal

The inspection and appraisal are critical stages of the process to make sure you are making a solid financial decision.

Now that you have found a home you’re under contract, you need to do what's called due diligence work. This is one of the most important steps to buying a house. This means respecting contingencies that were written into your real estate contract such as inspections and the appraisal. During the home inspection phase of the home buying process, the physical condition of the property and any potential health or safety issues are evaluated. Your REALTOR® will most likely recommend a home inspector, but if this doesn't happen you can ask friends or family for referrals. It’s important to find an inspector you trust, so you should spend a little time on the phone having a short conversation learning about the inspection process and what they will be looking for. You should also share your priorities and or concerns before you choose someone. Home inspectors are certified, not licensed. We can’t stress the importance enough of using an inspector that is certified.

In addition to the primary home inspection, there are some additional inspections that are really valuable. For example, Colorado has high radon levels, so a radon test is very important. If the home you're purchasing as well, you're going to want to do a well inspection. If you’re looking in an older neighborhood you’re going to want to do a sewer line scope. Also, for older homes, you might want to do a lead-based paint assessment as well as testing for the existence of asbestos or mold. Again, your REALTOR® should help guide you and request specific tests from the inspector.

Once you have the results back from the property inspection study them carefully. When you and your REALTOR® have a good idea of the property’s condition as well as any issues and or problems you’ll decide how and if you want to proceed.

If you choose to proceed you have two choices; first, you can take the house as-is and proceed to close. This tends to happen more in a seller’s market. The second choice is, along with your REALTOR®, you will put together a list of what is called unsatisfactory conditions. The seller then has the right to fix these things, offer a dollar amount settlement, or flat-out reject the proposal.

Negotiating after the home inspection can be very stressful, this is why it’s important to understand the condition of the current market. The best advice we can give is to pick a good REALTOR®!

Depending on the results of the inspection, and the seller's response to any of your requests, as the body you might want to purchase a home warranty. These policies go a long way in covering many of the little things oh, and big things that can go wrong with a property. considering the coverage, these policies are not very expensive.

In addition to the inspection, your lender will require an appraisal. The lender wants to know if the house is worth what they’re lending you to purchase it.

You, the home buyer, will pay for the appraisal but the lender will order it. The appraiser unlike the inspector is licensed and adheres to a strict set of guidelines. Appraisers undergo continuing education in order to maintain their licensure.

The appraisal happens without the buyer being present. The lender orders it, the REALTOR® will schedule it and the appraiser goes in alone and makes their assessment based on measurements, construction quality, number of rooms, floor plan, and condition. All of this data gets put into a spreadsheet and the appraiser applies debits and credits based on condition and quality as they relate to the comparable sales in the area in order to establish the appraised value.

Once complete, the results of the appraisal are sent to the lender and the buyer and their agent are notified as to the status, the property either appraised or didn’t appraise. To learn more about appraisals read our article What you need to know about appraisals.

You, the home buyer, will pay for the appraisal but the lender will order it. The appraiser unlike the inspector is licensed and adheres to a strict set of guidelines. Appraisers undergo continuing education in order to maintain their licensure.

The appraisal happens without the buyer being present. The lender orders it, the REALTOR® will schedule it and the appraiser goes in alone makes their assessment based on measurements, construction quality, number of rooms, floor plan, and condition. All of this data gets put into a spreadsheet and the appraiser applies debits and credits based on condition and quality as they relate to the comparable sales in the area.

Once complete, the results of the appraisal are sent to the lender and the buyer and their agent are notified as to the status, the property either appraised or didn’t appraise. To learn more about appraisals read our article What you need to know about appraisals.

Title Processing

Title processing will assure that there is clear title for the closing process.

One of the requirements of the real estate contract should be that the seller provides a clear title, free of any encumbrances, liens, or clouds. The seller would do this by providing a title insurance policy. This type of policy is issued by a title insurance company. In addition to providing title insurance, the title company can also provide escrow services and closing services. While many areas still use attorneys and escrow services, the title company is the most common way to take a transaction from under contract to closing. This is why the choice of the title company is very important. Here’s a bit about how to choose a good title company. Colorado is what is known as a “Title Theory” state. This means that the buyer gives the Deed to the lender until the loan is completely paid off. It’s important to note that the buyer retains all rights associated with having “title” to the property. Here is a deeper dive into Title vs. Deed.

Why do I need Title Insurance? This is because there are a number of different scenarios that can potentially make a title problematic. A clear title means the property is free of any liens, judgments, encumbrances, or other potential clouds on the title. The seller will provide the buyer with a title insurance policy at closing. This policy acts as a guarantee that the title is clear. During this process you’ll receive a lot of paperwork to read through, and so will your REALTOR®. Part of a Buyer Agent's job is to read the title work looking for potential problems and or exceptions to the title. They will look for things like easements and right of way agreements. One aspect of the title work you are going to want to read carefully will be any restrictive covenants or homeowner’s association documents associated with the property. These will be included with the title work. Familiarizing yourself with the HOA requirements will save you potential headaches in the future.

Closing on Your Home

The closing process is the final stage before being handed the keys. The closer will make sure all of the paperwork is signed and in order.

The closing process is the final stage before being handed the keys. The closer will make sure all of the paperwork is signed and in order.

You’re almost at the finish line on the steps to buying a house. It’s been a journey from start to finish! To help you finish up here is our comprehensive Closing Checklist for Home Buyers.

The final walk-through is the next part of a successful closing. This is the time to make sure the contract negotiations were executed correctly. It is in your best interest as the homebuyer to make sure that all of the i’s are dotted and the t’s are crossed. Details often get missed by sellers in the rush to get out of the house. For this reason, we do a final walk-through.

The final walk-through typically happens after the sellers have moved out, usually the morning of the actual closing. You should go to the walk-through with your inspection resolution list, receipts for repairs, a copy of your contract and original MLS sheet, and your REALTOR®.

As the home buyer, you’ll want to keep your eyes open during the walk-through. You’ll want to check for things like window coverings, appliances, and anything else that was agreed upon in either the contract or the inspection resolution.

If things aren’t as you expect them, the seller and you will have time prior to the actual closing to work out their differences. It is important to get these things worked out prior to closing.

Time to go to the closing table, in most cases, you will be closing at a title company. There are actually a couple of good ways to administer the closing of a real estate transaction. The two most common are title company versus escrow service. The method you use will depend on your particular location. Many states use an attorney to administer real estate transactions, and these attorneys in turn might use an escrow service to do much of the oversight of closing documents and due diligence work. Most Realtors® will use a title company to close their transactions. A title company provides escrow services, closing services, title research, and title insurance. A title company is a one-stop-shop for closing a real estate transaction. Your lender and the closing entity will coordinate the setup and maintenance of an escrow account. This account will be used to make your property taxes, homeowners insurance, and any mortgage insurance. In the closing, these expenses are referred to as Prepaids in Real Estate, this is because you are pre-paying for property taxes and your homeowner's insurance premium. Prior to arriving at the closing, your REALTOR® and/or lender should go over your final figures, including closing costs and the settlement statement. There, you’ll be presented with a large stack of paperwork. There will be lots of numbers and you’ll sign your name more times than you ever wanted to! There will be associated fees on both sides of the table for both the buyer and the seller. There’s nothing worse than getting to the closing table and having the buyer ask what are all these closing costs? Make sure you understand all the fees, premiums, and charges you are responsible for before signing. As far as the closing itself is concerned, there should be a closer from the title company at the closing table. It’s important that you ask questions of the closer, your REALTOR® or your lender to explain what you are signing. Yes, legal documents have important ramifications - don’t just sign because you feel pressure. After all the documents are signed, the closer should give you copies of everything you signed, any funds you are entitled to and of course most importantly, the keys to your new home. Whew! You made it!

New to the market

Handpicked Listings

Real Stories. Real Success.

What Our Clients Say