Many Colorado property owners were surprised when they received their Notice of Valuation from the Tax Assessor in May 2023. In Colorado, the notice of valuation (NOV) is the assessor’s estimate of what your home is worth. The NOV is also the number used to calculate your property tax responsibilities.

The booming real estate market Colorado experienced from 2020 through 2022 positively raised property values across the state. This appreciation was great if you owned or sold a home. But, the downside to this growth became apparent when homeowners realized how this appreciation would affect their property tax rates.

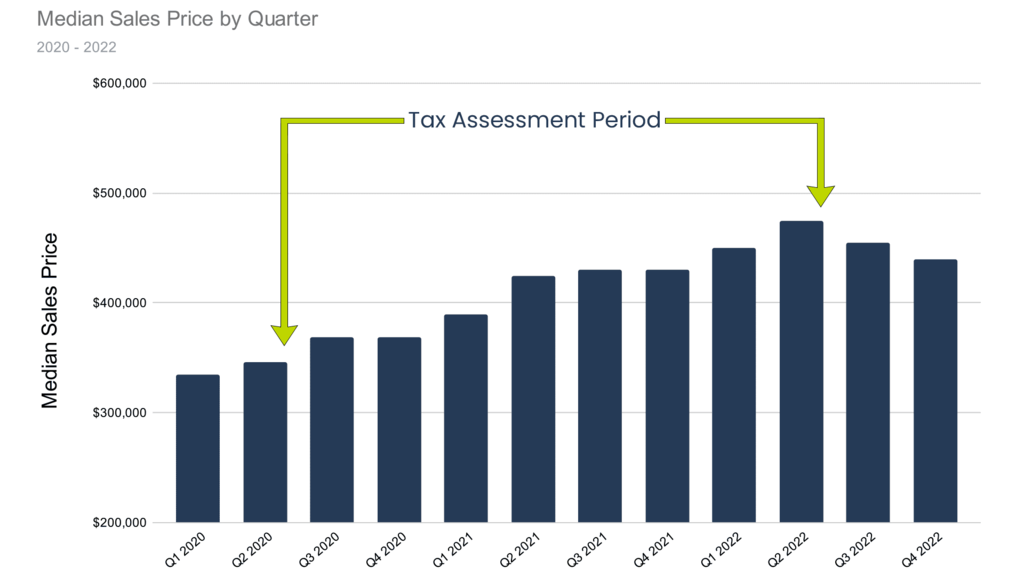

Over a two-year period (2020-2022) used for property valuation in Colorado, residential properties in El Paso County experienced a median increase in value of 44%. While this is a significant increase, it’s important to note that El Paso County’s increase is on the lower end compared to other counties across the state. Mountain and resort areas saw even more significant increases, ranging from 40% to 60%, with some near 70%.

Appreciation through assessment period in Colorado Springs and El Paso County.

Making Sense of Your Home’s Tax Assessment: The Valuation Process

It’s important to understand how property taxes work, how rates are established, and how your home value impacts your responsibility. Think about how many homes there are in El Paso County, Colorado. It’s a huge number! It would take too much time and money to look at every single home and determine its value every time taxes are due. So, the person in local government whose job is to figure out home values is the County Tax Assessor. Here in El Paso County, Colorado, the assessor uses a regression analysis tool to perform property assessment. It’s a smart way to get this big job done without it costing too much or taking forever.

Regression analysis is a tool that helps us understand how things relate to each other, much like solving a puzzle. For instance, drawing a best-fit line on a graph can help predict a house’s cost based on its size. If more factors, like yard size or house age, affect the price, it becomes more complex. Essentially, it’s a way to see how changing one thing might affect another, but it’s not perfect.

Errors can occur when tax assessors use regression analysis for property valuations. Mistakes in property data, an outdated or poorly structured model, rapid changes in property values, or unique properties can all lead to inaccurate estimates. Also, properties very different from others can skew results.

Disagree with Your Property Valuation? Explore the Appeal Process

If you think the assessor’s regression model analysis of your property is incorrect, you have the right to contest or appeal their opinion. In El Paso County, the deadline for the formal appeal process is June 8th 2023.

If you’re a homeowner planning to appeal your property tax assessment, you must have a valid reason. Simply feeling that your taxes are too high isn’t enough. You need concrete evidence that your property’s assessed value doesn’t match its actual fair market value.

If you decide to appeal, you must show the assessor why your home’s value is wrong. This means providing documentation that can help prove your point. This might be information about sales of homes like yours or details about problems with your home. These documents will help the assessor understand your point.

A homeowner might appeal their residential property tax assessment for several reasons:

Inaccurate Property Description: If the assessor’s records incorrectly describe the property (e.g., incorrect square footage, wrong number of rooms, size of the property, or other features), this can lead to overvaluation.

Overvalued Property: The assessed value might be higher than the actual market value based on recent sales of similar properties in the neighborhood.

Property Deterioration: If the property has significant damage or deterioration not accounted for in the assessment, it may warrant an appeal.

Declining Local Property Values: If property values in the local market or neighborhood have generally decreased, but the assessment doesn’t reflect this, it could be grounds for an appeal.

Inconsistent Assessments: The assessment might be considered unfair if the home is assessed at a higher value than similar properties in the area.

Missed Tax Exemptions or Credits: The homeowner may qualify for certain tax exemptions or credits (e.g., homestead exemptions, senior citizen discounts) that were not applied in the assessment.

Assessment Increase Cap Exceeded: In some places, there are laws that cap how much the assessed value can increase year over year. If this cap is exceeded, it could be a reason for appeal.

Calculation Errors: There could be simple mathematical errors in calculating the property tax.

Recent Appraisal Below Assessed Value: If the homeowner’s recent appraisal values the property below the tax assessment, this can be a basis for an appeal.

Negative Influences Not Considered: The assessment may not have considered negative influences that could impact the property’s value, such as being located near a noisy highway, landfill, or other undesirable features.

Comparable Sales Data: Your Roadmap to a Successful Tax Appeal

Unless there’s a mistake in your property’s description, damage to your property, missed tax breaks, or a simple error, you’ll need to show the assessor comparable home sales data to support your case.

For your appeal, you need to use sales data from similar homes sold between June 30, 2020, and June 30, 2022. The closer the sale date is to June 30, 2022, the better. This is because the assessor increases the value of earlier sales to match current prices. So, homes sold later will need smaller adjustments.

Here are a couple of ways you as a homeowner, can find comparable sales data.

Real Estate Websites: Many real estate websites, like Zillow, Redfin, and Realtor.com, provide recent sale prices and detailed information about homes in your area. Our site offers a home valuation tool that won’t give you comps, but will give you a good idea of how much your home is worth.

County Assessor’s Website: Check the county assessor’s website. They often have databases of recent property sales that you can search by neighborhood, property size, and other factors. The El Paso County Assessor site has a feature that will produce comparable sales data. the problem with this information is it’s the very information that was used to come up with the figures you’re appealing.

Multiple Listing Service (MLS): While typically used by real estate professionals, some MLS data may be available to the public. It provides comprehensive details about property sales, including selling price, property details, and photos.

Local Real Estate Agents: Real estate agents have access to the most up-to-date and comprehensive sales data. They may be willing to help, especially if you’ve had a relationship with them in the past.

Title Companies: These companies often have extensive property sales data. Some offer this information as a service, though there may be a fee.

Appraisal Services: Professional appraisers have access to detailed sales data. Hiring one could be good, especially for high-value properties or complex cases.

Remember, the key is to find “comparable” sales—properties that are similar to yours regarding size, condition, location, and features. These will provide the most persuasive evidence for your appeal.

Leverage a Realtor’s Expertise for Your Property Tax Appeal

The best way to find compelling comparable properties is to get some help from a Realtor. Realtors have access to sales data from the MLS and RPR (Realtors Property Resource) and understand what types of features and amenities move the needle on property values.

Since every property is unique, appraisers, real estate agents, and county tax assessors use a method of adding and subtracting values (credits and debits) to account for these differences. This system helps them accurately determine a property’s market value.

Let’s say you live in House A, your home backs up to a busy street, and your property tax valuation seems too high. You might find a comparable property, like House B, which recently sold, this home has a pool, and backs up to open space. If House B sold for less than your assessed value, you can use this as evidence in your appeal. You would argue that House B is similar to your house, but your property was overvalued because the assessor didn’t appropriately account for the negative impact of your proximity to a busy street, and the pool.

Essentially, by comparing your home to similar properties and considering various features (like a pool or location near a busy street), you can argue for a more accurate assessment of your home’s value.

Realtors have access to tools like the Multiple Listing Service (MLS) and RPR, which can quickly identify and filter for properties that help make your case if you do, in fact have one. This detailed comparison can significantly strengthen your property tax appeal, making it more convincing.

Navigating Your Appeal in El Paso County: We’ve Got Your Back

If you’re grappling with a property tax appeal, our experienced Realtors are here to help you. By leveraging their market expertise, they can effectively guide you through your assessment appeal process. If you would like some help, please fill out this form. One of our market specialists will promptly reach out to you. Your path to a successful appeal starts here.

The El Paso County Tax Assessors website makes the appeals process easy. If you visit their site, you can use their Find Property tool to search for your home. Once you find your property, use can use the “comper” tool to see the comparable sales the assessor used to establish your assessment value. You can also use this tool to find comparable properties to use in your appeal.

Once you are ready to make your appeal, you’ll start the process by clicking the Appeal button.

In Conclusion

You have the right to appeal your tax valuations independently; partnering with a professional is crucial for maximizing your chances of success. Enter the realtor, your ultimate ally in the complex world of tax appeals. These experts have extensive local real estate market knowledge and excel at property valuation. By enlisting a realtor’s support, you gain an advocate to fight for your case. Teaming up with a Realtor is undoubtedly your best bet for increasing your chances of winning the appeal and reducing your property tax burden.