Latest Blog Posts

What's Your Colorado Springs Home Worth

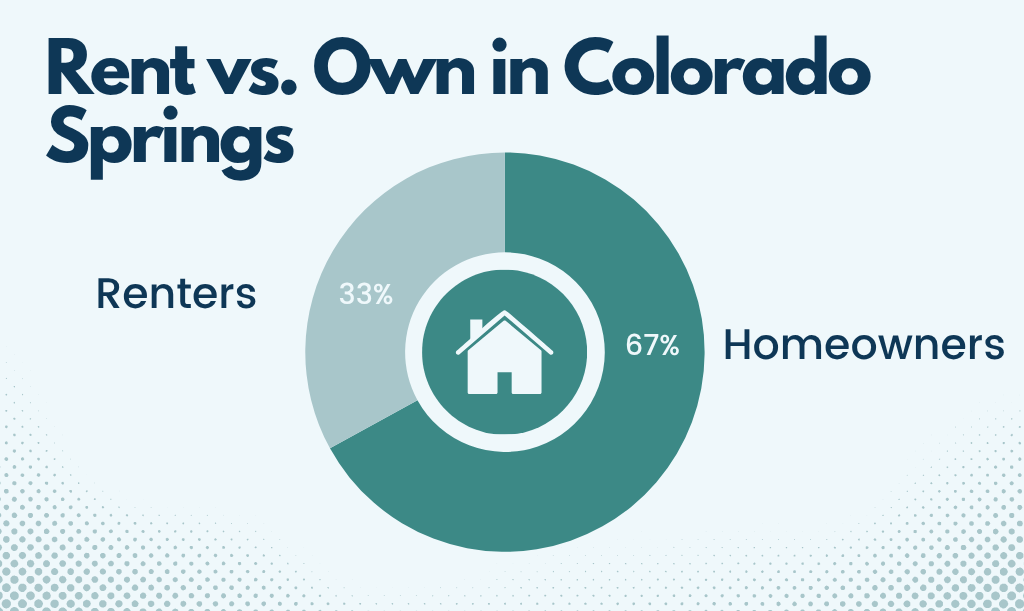

"What's my home worth?" It's the first question nearly every homeowner asks when they find out I'm a REALTOR®. Honestly, I get it. There's something irresistible about knowing whether you've made mone…

When is the Best Time to Sell My House

Colorado Springs homes are taking 61 days to sell—57% longer than the national average. With inventory at 3,338 homes and climbing toward 4,500+ by spring, your decision to sell now or wait could impa…