Residential solar installations grew by 15% in 2023, driven by technological advancements and supportive policies. This momentum is expected to carry into 2024, reshaping the future of home solar power.

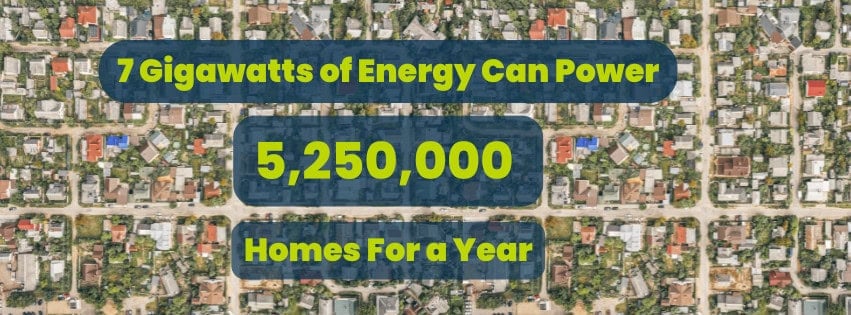

According to the Solar Industries Association (SEIA) and Wood Mackenzie reports, the U.S. solar industry saw continued growth in 2023, with a record-breaking number of new installations. Specifically, the residential solar sector added over 7 GW of new capacity in 2023, marking a 15% increase from 2022. The first quarter of 2024 has shown strong momentum, continuing this growth trend.

Several key factors are driving this interest in residential solar energy. First, the cost of solar panels is dropping due to technological advances, making them more affordable for homeowners. However, it’s worth noting that the cost reduction rate has decelerated, with the decline being just 3% in 2023, compared to an average of 5-7% annually in the previous decade. This slowdown has been attributed to increased material costs and labor shortages. Secondly, financial incentives like a federal solar tax credit and rebates from many states further reduce the cost.

The federal solar investment tax credit (ITC) was extended and renamed the Residential Clean Energy Credit (RCE). If your system was installed between 2022 and 2032, you’ll qualify for a 30% tax credit. The credit reduces to 26% in 2033 and drops to 22% in 2034.

Additionally, solar panels allow homeowners to generate electricity, making them less reliant on the grid and safeguarding them from rising energy prices. They can even sell any extra energy back to the grid.

Solar Power and Your Home: A Bright Future or Just a Shiny Promise?

As people become more conscious of their environmental footprint, residential solar energy emerges as a straightforward and effective sustainable solution. This growing environmental consciousness, coupled with the potential for protection from volatile energy costs and the ability to generate income from surplus energy, has led to a surge in homeowners’ interest in installing solar panels.

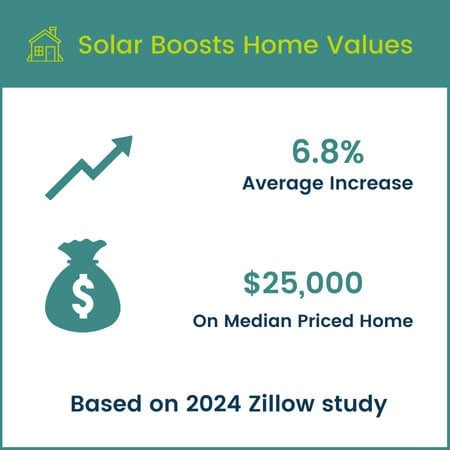

Part of this appeal lies in the expectation that solar panels can enhance the value of their homes. Recent research shows that homes with solar installations sell for more than those without solar. For instance, a 2024 Zillow study found that, on average, solar-equipped homes across the U.S. sell for 6.8% more, translating to an approximately $25,000 increase on a median-priced home.

While The Lawrence Berkeley National Laboratory research indicates solar-powered homes increase the value of your home, it’s essential to recognize that installing solar panels doesn’t guarantee an automatic increase in property value. The impact on the value of a home can vary depending on many factors.

Solar Decisions: Understanding Your Path to Green Energy

It’s important to remember that how you get your solar panels—whether you buy them outright, lease them, or go with a power purchase agreement—can make a big difference when it’s time to sell your house. Market segmentation shows millennials are particularly attracted to solar energy, viewing it as a long-term investment. In contrast, older demographics may prioritize ease of use and clear financial benefits, influencing how solar is perceived in different regions.

If you own your panels, it could boost your home’s value. But if you’re leasing your panels or have a power purchase agreement, potential buyers might be a bit tricky. When deciding how to go solar, consider how each option might affect you in the long run, especially if selling your home is in the cards for the future.

Here are the most common ways to get solar for your house; each has its own set of advantages and considerations:

- Purchase Solar Panels Outright: This option involves buying the solar panels directly, either with savings or through a loan. You’re the outright owner, which allows you to benefit from all the energy savings and federal tax credits and potentially increase your home’s resale value. However, you’re also responsible for maintenance and repairs.

- Solar Loans: Like outright purchasing, a solar loan allows homeowners to own solar panels. This option is beneficial if you want to own the system but don’t have immediate funds. You can pay off the loan over time, often with payments that are less than your current electric bill. Like an outright purchase, you’re eligible for federal tax credits.

- Solar Lease/Power Purchase Agreement (PPA): In a leased solar panel system or solar PPA, you agree to have a company install solar panels on your roof. The company owns and maintains the panels, and you make predetermined monthly lease payments. The rate is typically lower than the rate charged by a utility company. You don’t get the tax credits, but you don’t have to worry about maintenance or upfront costs. This arrangement can pose particular challenges when it’s time to sell, mainly because the solar agreement is tied to the property, not the homeowner.

- Solar Energy Purchase Agreement (SEPA): Similar to a PPA, a SEPA involves a solar provider installing and maintaining a solar panel system on your property. You agree to purchase the solar energy produced by the system at a set price. This contract lasts a set number of years and often includes an option to buy the system at the end of the term. Like a PPA, the SEPA can cause problems when it’s time to sell.

- Community or Shared Solar: This is a good option for those who can’t or don’t want to install panels on their property. You buy a share in a community solar project and receive credits on your energy bills for the power your share produces. Like Solar Leases/PPAs, the new homeowner must agree to take over the shared solar agreement. It can complicate the sale if they’re not interested or can’t meet the solar company’s requirements. Knowing which of these arrangements you have for your solar system is essential. Each requires a different approach when it’s time to sell your house.

Navigating the Solar Sale: A Roadmap for Homeowners

Many potential homebuyers still feel uneasy about solar panels due to uncertainties around financing and maintenance. In this part of the article, we aim to simplify this. Home sellers and listing agents are vital in clarifying solar panel ownership and care for buyers. We’re here to help make your solar home appealing and understandable for the right buyer.

Real estate professionals emphasize the importance of translating green features into tangible benefits, like cost savings from energy efficiency, to attract a broader market. Rick Thompson, a REALTOR® and co-owner of Bright Leaf Homes, a home builder specializing in sustainable construction in the Chicago suburb of LaGrange, advises focusing on quantifiable metrics such as the Home Energy Rating System (HERS) to showcase a home’s efficiency. Realtors should use standardized green data fields in MLS listings to highlight sustainable features effectively. They are also encouraged to build networks with green-certified professionals and use tools like energy audits and utility bill disclosures to demonstrate the true value of green homes to potential buyers.

Selling with a Solar Lease/Power Purchase Agreement (PPA):

You can typically take one of two paths when selling a home with leased solar panels. The first involves the buyer assuming the solar lease agreement. This transition must be coordinated with the leasing company and the buyer, who must qualify based on their credit.

This approach allows the homeowner to pass on the benefits of the solar lease, including lower energy costs, without any additional expenditure. However, some buyers may need to be more open about signing a lease agreement, so communicating the benefits is essential.

The second option is to pay off the solar lease at closing using funds from the home’s sale. Doing so removes the lease’s complexity from the negotiation process and can be more attractive to prospective buyers. However, the payoff amount could be substantial depending on the terms of your lease, so it’s essential to consider how this would impact the net proceeds from your home sale. Always consult with a real estate professional familiar with solar leases to ensure you’re making the best decision for your situation.

Selling with a Community or Shared Solar Agreement:

There are a few key steps to follow when selling a home with a Community or Shared Solar arrangement.

Contact the Shared Solar Program Provider: The first step is to contact the community solar program provider. Discuss your selling plans and understand the options for transferring your solar share to the new owner.

Understand the Agreement: It’s crucial to comprehend the terms of your agreement. Some programs may allow the transfer of the solar panel share to the new homeowner, while others require you to sell your share to the program or another community member.

Discuss with Your Real Estate Agent: Ensure that your real estate agent is aware of the community solar share and fully understands its implications on the home sale. They need to be prepared to explain this unique setup to potential buyers.

Include in Home Listing: The shared solar agreement should be included in the home listing. Potential buyers should know that the home is part of a community solar project. This might be an attractive selling point for some buyers interested in renewable energy but are willing to install panels on their homes.

Homebuyer Agreement: If the buyer is interested in taking over the solar share, they may need to agree to the terms of the community solar program and apply to the program themselves. Handle this before the sale to ensure a smooth transition. Transferring solar leases or PPAs can be complicated if the buyer doesn’t qualify or agree to the terms. Sellers might face expensive buyout fees if the transfer fails, impacting the sale.

Legal Consultation: Depending on the complexity of the shared solar agreement, it might be advisable to consult with a real estate attorney to ensure all legal bases are covered, and the interests of all parties are protected. Some states have unique laws that could affect solar agreements during home sales. For instance, in Colorado Springs, existing HOA covenants can be protected against newer pro-solar laws, limiting homeowners’ rights to install solar panels.

Remember, each community solar program has unique rules and regulations. For the most accurate information, refer to your specific agreement and consult the program provider.

Selling a Home with a Solar Energy Purchase Agreement (SEPA):

When selling a home with a Solar Energy Purchase Agreement (SEPA), homeowners should consider the following steps:

Review the SEPA Contract: Carefully examine the terms and conditions of the SEPA contract. Understand the agreement’s duration, pricing, and other obligations or restrictions.

Contact the Solar Provider: Contact the solar provider to discuss the sale and determine available options. Inquire about transferring the SEPA to the new buyer or exploring other alternatives.

Inform Your Real Estate Agent: Make sure your real estate agent knows the SEPA and its implications for home sales. They need to understand how to communicate this arrangement effectively to potential buyers.

Include SEPA Details in the Listing: Highlight the SEPA in the home listing to provide transparency to potential buyers. Clearly explain the benefits and savings associated with the solar energy purchase agreement.

Educate Potential Buyers: Be prepared to educate potential buyers about the SEPA and its advantages. Share information on the locked-in energy rates, potential savings, and the environmental benefits of clean energy, including solar power.

Coordinate the Transfer Process: If the new homeowner wishes to assume the SEPA, work closely with the solar provider to facilitate a smooth agreement transfer. Ensure that all necessary documentation is completed and submitted promptly.

Consider Legal Consultation: If any complex aspects or legal considerations are related to the SEPA, consulting with a real estate attorney may be wise to ensure a smooth and legally compliant transaction.

Selling a Home with Leased Solar Panels:

When selling a home with leased solar panels, several key steps are involved in the process:

Review the Lease Agreement: Begin by carefully reviewing the terms and conditions of the solar lease agreement. Understand the duration, monthly payments, and any transfer or buyout provisions outlined in the contract.

Contact the Solar Leasing Company: Contact the solar leasing company to inform them of your intention to sell the property. Inquire about their procedures for transferring the lease to the new homeowner or explore potential options for prepaying or buying out the lease.

Inform Your Real Estate Agent: Make sure your real estate agent knows about the leased solar panels and understands the implications for the home sale. They can help communicate this information effectively to potential buyers.

Talk to Your Lender: It’s important to ensure buyers talk to any mortgage lenders they are working with. Leasing panels can impact qualifying ratios, and in some cases, this could make it difficult or impossible for the buyer to get their loan.

Include Lease Details in the Listing: Mention the leased solar panels in your home listing to provide transparency to potential buyers. Highlight the benefits of the leased solar system, such as reduced energy costs, environmental sustainability, and a reduced carbon footprint.

Educate Potential Buyers:

- Be prepared to educate potential buyers about the leased solar panels.

- Explain how the lease works, the financial obligations, and the potential savings in energy costs.

- Provide them with any relevant documentation or information provided by the leasing company.

Potential Buyers Should Do The Following:

Understanding what to look for is crucial for those considering purchasing a solar-equipped home. Here’s a checklist to help you make an informed decision:

- Confirm the ownership status of the solar panels (owned, leased, or part of a shared agreement).

- Review the terms of any solar lease or power purchase agreements.

- Ask for documentation on the system’s installation, warranties, and maintenance history.

- Inquire about the solar system’s impact on utility bills and potential energy savings.

- Ensure you understand any potential costs or responsibilities associated with the solar panels.

Coordinate the Lease Transfer or Buyout: If the buyer is interested in assuming the solar lease, work closely with the leasing company to facilitate the transfer process. Ensure that all necessary paperwork and requirements are fulfilled. Alternatively, if the buyer prefers not to assume the lease, explore options for prepaying or buying out the lease, if feasible.

Legal Considerations: Depending on the complexity of the lease agreement, it may be advisable to consult with a real estate attorney to ensure all legal aspects are handled appropriately and protect the interests of all parties involved. While many states protect homeowners from unreasonable HOA restrictions on solar panels, disputes can still arise, potentially requiring legal action. States like California and Florida have laws that provide some protection, but legal challenges may still be necessary.

Selling a House with Owned Solar Panels

This is the most straightforward scenario when it comes to selling a house. The home seller still needs to take a few critical steps:

Gather Documentation: Collect all relevant documentation about the solar panel system, including purchase contracts, warranties, permits, and any maintenance records. This information will help potential buyers understand the system’s history and performance.

Assess the Solar Panel System: Evaluate the condition and efficiency of the solar panels. Consider scheduling a maintenance check or inspection to ensure everything is in proper working order. The buyer will most likely have the panels inspected, but it’s better to discover any problems before the buyer does.

Determine the Value: Determine the value of the solar panel system. Research the current market value of similar systems and consider consulting with solar energy professionals to assess the system’s worth. This information will help you determine a fair price for the home.

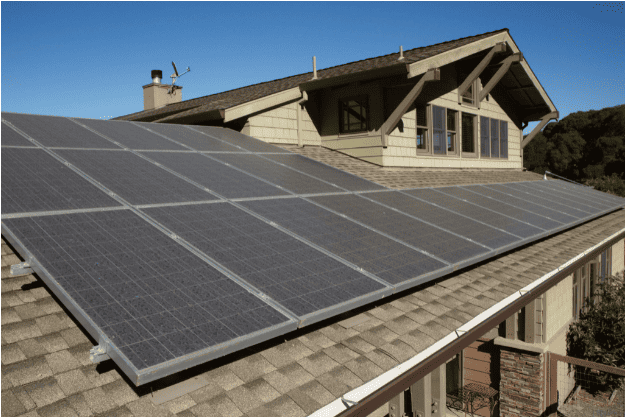

Bill Gassett of Massachusetts Real Estate News provides excellent guidance on understanding how adding solar can impact your property value. While solar panels generally help a home’s market value, there are some circumstances where this could be tempered. For example, installing them on the front of the house can undermine curb appeal. Many potential buyers do not like their looks and don’t want to see them from the street. If possible, you should always try to install them on the back of the roof, where they are out of sight. You will see a much better return on investment as the pool of buyers will increase. This is especially true in luxury homes where the front of the house is so vital to a buyer.

Highlight the Benefits: In your listing and marketing materials, emphasize the advantages of owning a home with solar panels. Showcase the potential savings on utility bills, the environmental benefits, and any available tax incentives or rebates.

Disclose Information: Provide full disclosure about the solar panel system to potential buyers. Include the system’s age, capacity, warranties, and financing arrangements. Transparent communication builds trust with potential buyers.

Collaborate with Your Real Estate Agent: Work closely with your real estate agent, ensuring they comprehensively understand the solar panel system and its value. They can effectively communicate these details to potential buyers and address any questions or concerns.

Facilitate Buyer Due Diligence: Allow interested buyers to conduct due diligence on the solar panel system. Provide access to any relevant documentation, offer opportunities for inspections or consultations with solar experts, and be responsive to any inquiries they may have.

Transfer Ownership and Coordinate Installers: Work with the buyer’s agent and any necessary third parties to smoothly transfer ownership of the solar panel system. Coordinate with installers or technicians to update ownership information and ensure a seamless transition.

Update Utility Accounts: Inform your utility company about the change in solar panel ownership and arrange for the new homeowner to assume responsibility for any net metering or utility interconnection agreements. Sellers in certain states must disclose solar-related contracts and restrictions. Failing to do so could lead to post-sale legal disputes, making it crucial to understand and comply with state-specific disclosure laws.

In Conclusion

When selling a home with solar panels, sellers must know the steps involved and communicate effectively with potential buyers. Whether the solar panels are owned, leased, or part of a community/shared solar arrangement, sellers should gather necessary documentation, assess the system’s condition, determine its value, and highlight the benefits in their listings.

Collaborating with a knowledgeable real estate agent and facilitating buyer due diligence are crucial. Sellers must transfer ownership smoothly, coordinate with installers if necessary, and update utility accounts. By following these steps, sellers can navigate the process confidently and ensure a smooth transition for themselves and the buyers.

It’s worth noting that the solar industry continues to evolve rapidly. Recent technological advancements, such as more efficient panels and improved energy storage solutions, make solar installations even more attractive to potential buyers. In particular, the latest advancements have increased panel efficiencies to over 22%, with innovations like bifacial solar panels and the use of perovskite materials contributing to these gains. As solar technology continues to improve, the appeal of solar-equipped homes is expected to grow. At the same time, growing interest in solar with home battery storage, due to increased grid outages, and new financing options like power purchase agreements with performance-based incentives are making solar more accessible and appealing. Additionally, the growing interest in sustainable living and energy independence will increase the appeal of solar-equipped homes in the coming years.