Over the last few years, 75-80% of American home buyers have required a mortgage to purchase their homes. Yet most of us understand very little about the mortgage industry.

This is largely due to the fact that we, as borrowers, actually only see a small portion of the overall mortgage picture. Borrowers are involved in the pre-qualification and application process for a new loan, of course, but after the purchase closes, we simply make our monthly mortgage payments as scheduled, and give very little (if any!) thought to the evolution of our loan.

But it’s important for buyers to understand the basics of the bigger mortgage industry picture, especially how money flows in the mortgage world, where it comes from and where it goes.

Knowing how the money flows through the mortgage industry helps borrowers understand some of the quirks of home loan applications. You’ll be able to better tolerate the paperwork and the aggravation of applying for a mortgage if you can see why the paperwork and documentation are necessary for the lender to approve the loan.

Did you know that much of your mortgage payment could actually end up on Wall Street? For that reason, some of the loan origination paperwork is required specifically to protect investors. It may still be a hassle to provide months of financial documentation to finalize your loan, but it helps to know that there is a reason behind these requirements.

In this article we’ll look at the basics of the mortgage industry, primarily focusing on how the money flows through the mortgage world.

Three Tiers of Mortgage Lending

There are three tiers of mortgage lending: The Loan Origination, The middleman, and The Secondary Market.

The Loan Origination

The loan origination tier is the one most familiar to borrowers because it requires their direct involvement. Loan origination is the process by which a borrower applies for a new home loan, and the lender processes the borrower’s application. The loan origination tier is complete when the lender either declines the application or approves the application and disburses the funds. As a buyer, you can choose one of the four primary types of lenders to work with through the loan origination tier: Correspondent Lenders, Direct Lenders, Mortgage Brokers, and Portfolio Banks.

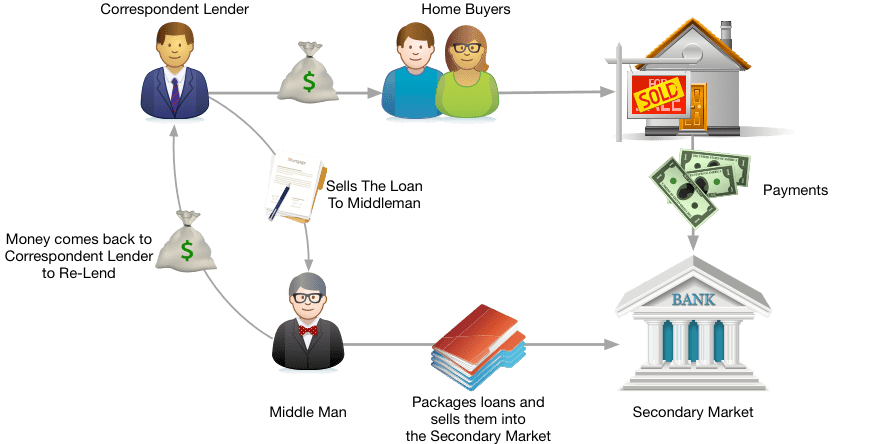

Correspondent Lenders

Correspondent lenders are smaller companies with some of their own money to lend to buyers. They may be on the small side, but there are many in operation. Correspondent lenders are like the “Mom and Pop Shops” of the mortgage world.

The strength of correspondent lenders lies in their service and their relationships in the community. Their originators or salespeople (aka loan officers) typically provide a personal level of service that larger lenders can’t match. And borrows often choose correspondent lenders based on personal relationships and trust. Good correspondent lenders receive lots of referral work from their satisfied customers in the local community.

But here’s where correspondent lending gets interesting: to make sure they have enough money to originate new loans to new buyers, correspondent lenders will sell most of their loans, through investors, to “mortgage aggregators” like Fannie Mae and Freddie Mac (more on Fannie and Freddie coming up!). This allows correspondent lenders to maintain a high level of liquidity, so they can have cash available to finance more loans.

Here’s an example of how correspondent lending works

Who are Fannie Mae and Freddie Mac?

Fannie Mae and Freddie Mac are government entities that provide liquidity, stability, and affordability to the mortgage market. They exist to act as “mortgage aggregators”, which means they buy loan portfolios from loan originators to replenish the fund’s originators have available to re-loan. Fannie and Freddie may hold these portfolios as-is, or they may package them into “mortgage-backed securities” (MBSs) to sell on Wall Street.

This process serves two main purposes:

- It ensures that loan originators have a continuous, stable supply of money to lend to buyers, and

- It encourages investors to invest in MBSs by increasing the credibility of the investments through government involvement. Additional MBS investors provide more money to fund real estate loans so the cycle can repeat.

Because of this relatively complex system, correspondent lenders must be very cautious when approving home loans. If a loan was underwritten incorrectly, for example, the lender might be forced to buy it back from the secondary market, which would cut into the amount of money they would have available to originate new loans. So you can expect correspondent lenders to be thorough and ask for more than the minimum requirements during the home loan application process.

You may have noticed that the loans are sold back to Fannie Mae and Freddie Mac through an investor. Who are these investors? They’re typically big players in the mortgage industry (large enough organizations to have accounts with Fannie Mae and Freddie Mac). In fact, many of these investors are Direct Lenders, which is the next option in our list of the four primary types of lenders to work with through the loan origination tier.

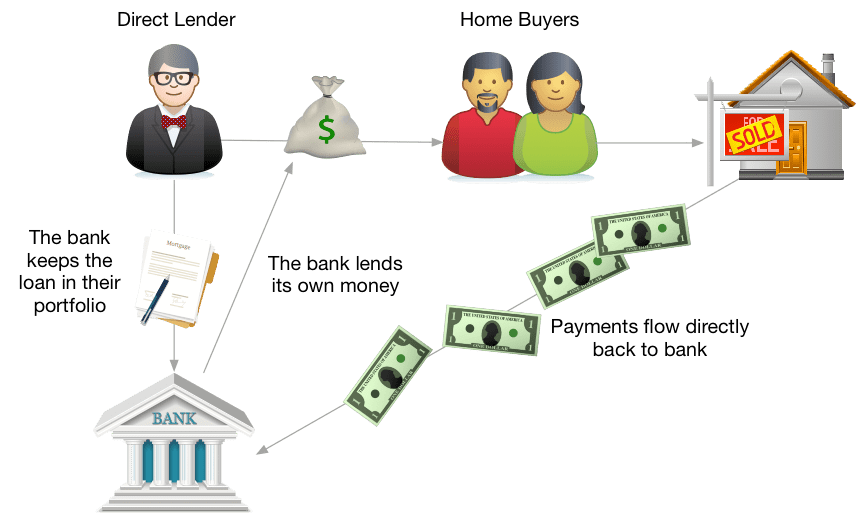

Direct Lenders

Direct Lenders are the “Big Guns” of the mortgage industry. Think of the big banks like Chase and Wells Fargo.

Direct lenders will keep some of the loans they originate in-house as part of their portfolio, but they will sell off many of the loans to mortgage aggregators through investors, just like we saw with correspondent lenders.

In fact, direct lenders each have a division which functions as a correspondent lender in the origination tier. But they also each have a department that packages the loans and offers them for sale on the secondary market. Furthermore, they have their own money and underwriters.

Direct lenders process high volumes of loans, so they can often offer the lowest interest rates to borrowers.

One thing direct lenders don’t do is to help you compare interest rates and terms with other direct lenders. Borrowers need to apply with each direct lender individually to see the rates and terms for which they qualify with each direct lender.

This can be a time-consuming process for buyers as home loan applications can be lengthy, and the financial documentation required to officially approve a home loan can be excessive. But, as I mentioned, direct lenders can usually offer the lowest rates, and selecting the right direct lender could potentially save buyers tens of thousands of dollars in interest over the course of the loan.

Here’s an example of how direct lending works

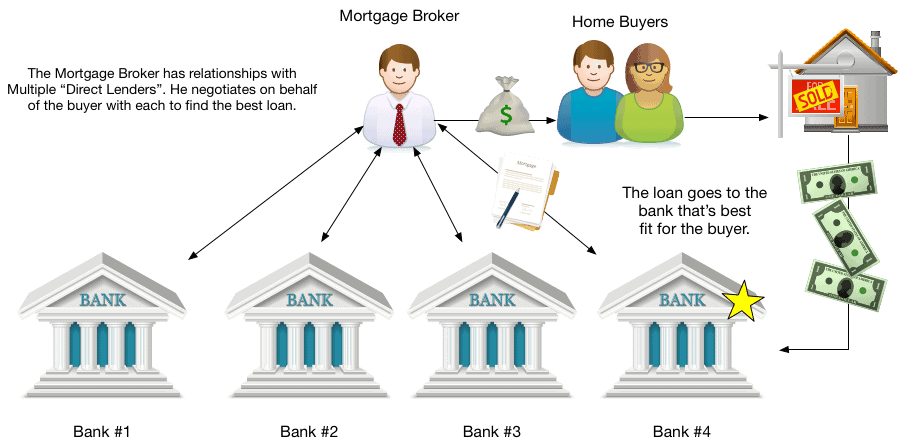

Mortgage Brokers

For buyers who aren’t willing to invest the time applying to individual direct lenders, there are mortgage brokers. Mortgage brokers shop direct lenders to find you the best mortgage terms available for your unique circumstances.

Mortgage brokers don’t have their own money or their own underwriters; they simply act as a middleman to match borrowers with lenders. Mortgage brokers can compare wholesale mortgage rates from a large number of lenders at once to find the best options for buyers.

As a borrower, your mortgage broker will provide you with offers from various lenders, you can decide which lender you’re interested in dealing with, and your mortgage broker will present your file to the chosen lender and wait for approval. Mortgage brokers do a lot of the legwork for you, working on your behalf with the lender.

You should know that pricing with mortgage brokers can be just as competitive as with direct lenders. This just depends on how much compensation the broker needs to make on the deal.

Mortgage brokers are an especially good option for borrowers who have trouble qualifying for a mortgage from correspondent and direct lenders, or for borrowers who need to finance tricky deals. Brokers have insider knowledge of multiple lending partners, so they can find solutions to some complex qualification and financing issues.

Here’s an example of how a Mortgage Broker works

Portfolio Banks

Portfolio Banks are usually credit unions or savings and loan institutions. First Bank or BBVA Compass Bank are two portfolio banks in Colorado.

Unlike correspondent lenders and direct lenders, portfolio banks originate loans for their own portfolio; portfolio banks don’t originate loans to be sold into the secondary market.

Because the loans aren’t originated for sale on the secondary market, portfolio banks have much greater flexibility, which can seriously benefit borrowers. For instance, Portfolio Banks can:

- Approve borrowers with fewer qualifications

- Work with smaller down payments

- Offer higher maximum loan limits

- Waive requirements on property condition

- Originate loans on multiple properties (even if the buyer already owns properties with existing mortgages).

There are four main types of portfolio loans: Balance Sheet Loans, Blanket Mortgages, Jumbo Loans, and Cash-Out Refinancing.

Balance Sheet Loans

A balance sheet loan is a loan that a lender keeps on its balance sheet (as opposed to selling the loan). Balance sheet loans don’t comply with Fannie Mae’s loan guidelines, or they may be otherwise unsuitable to sell in the secondary market. They typically have different regulations and requirements, making them comparatively flexible.

Blanket Mortgages

A blanket mortgage is a portfolio loan that finances two or more investment properties under a single mortgage. Blanket mortgages help investors buy, sell, and hold multiple investment properties at a given time.

Jumbo Loans

A jumbo portfolio loan is a portfolio loan that exceeds the maximum loan limits outlined by Fannie Mae.

Cash-Out Refinancing

A cash-out refinance is the act of refinancing an existing investment property with a new long-term loan to extract equity in the form of cash from the property. A cash-out refinance loan term is between 15 and 30 years. This loan type is often used to finance home improvement projects.

The Middleman

After the loan origination tier, where loans are processed and funds are distributed, most loans are passed to the middleman tier.

In the middleman tier, loan originators sell loans to middlemen, who package them into large portfolios to be sold on the secondary market.

Who are these middlemen? In the simplest terms, middlemen are institutions with relationships to mortgage aggregators.

Middlemen are usually (but not always) direct lenders like Chase and Wells Fargo. This can be confusing because direct lenders also originate loans, as mentioned previously. But because they are giant firms, they have separate departments available to handle loan originations functions and middleman functions.

There are strict guidelines for the loans that get packaged into portfolios. This is especially true when government agencies like Fannie Mae, Freddie Mac, and Ginnie Mae are involved. I’ve touched on Fannie Mae and Freddie Mac as mortgage aggregators. Ginnie Mae performs the same function as Fannie and Freddie, but specifically for government-guaranteed loans like VA and FHA loans.

Each individual loan’s file is reviewed by a dedicated auditor before the loan is added to a portfolio. If the file doesn’t meet all the guidelines, the originating lender is required to buy back the loan. The originating lender is then holding an “unsellable” loan, restricting their liquidity since their money is tied up in a loan that can’t be sold. This is why mortgage companies rigidly follow all the rules and meet all the requirements during the loan origination tier.

It’s important to note that, while middlemen sell these packaged loans on the secondary market, they retain the servicing of the individual loans (collecting payments, issuing account statements, etc.). This servicing provides another income stream for the middleman.

Now that the middlemen have packaged the loans into portfolios, we can move on to the final tier of mortgage lending: the secondary market.

The Secondary Market

The secondary market is where mortgage loan portfolios and servicing rights are bought and sold between four parties: Mortgage Originators, Mortgage Aggregators, Securities Dealers, and Investors.

Mortgage Originators

Mortgage Originators are the institutions introduced in our discussion of the loan origination tier (correspondent lenders, direct lenders, mortgage brokers, and portfolio banks). They work with borrowers to complete the mortgage application process and distribute the funds.

Mortgage Aggregators

Mortgage Aggregators are the groups that purchase the loan packages from the middlemen and securitize them into mortgage-backed securities (MBSs) I mentioned earlier. This includes Fannie Mae, Freddie Mac, and Ginnie Mae. Aggregators make their money by purchasing individual mortgages at lower prices and then selling the pooled MBSs at a higher premium.

Currently, Fannie Mae and Freddie Mac are both limited to purchasing loans of $424,100 or less. This figure is reevaluated every year to accommodate changes in real estate prices.

Once Fannie Mae, Freddie Mac, and Ginnie Mae have purchased the loans, they are converted into mortgage securities and bonds and offered as trading commodities. It’s interesting to note that, because Ginnie Mae handles government-guaranteed loans, their yield is generally higher than those of Fannie Mae or Freddie Mac.

Securities Dealers

Securities dealers are the Wall Street brokerage firms that offer MBSs on the stock market.

Investors

Investors are those who trade in MBSs. MBSs are a reasonably secure investment simply because people generally pay their mortgages unless there is some extenuating circumstance preventing them from doing so. So MBSs will always be in demand, and there will always be a market for them.

The U.S. government currently holds over a trillion dollars in U.S.-originated MBSs, but it started selling off some of its MBS holdings in 2017. Foreign governments, pension funds, insurance companies, banks, GSEs (Government-Sponsored Enterprises), and hedge funds all invest heavily in mortgages.

The Purpose of the Secondary Market

As I mentioned briefly in the introduction to Fannie Mae and Freddie Mac earlier in this article, the main purpose of the secondary mortgage market is to support originating lenders in lending more money to potential homeowners.

The secondary market serves this purpose by 1) buying the originated loans to provide a continuous, stable supply of money to lenders and 2) lending credibility to the MBSs as investments to encourage stock market investors to invest in MBS’s so more money can be available for lending.

Conclusion

Many buyers are confused and frustrated by the home loan application process and the requirements of mortgage lenders. But a peek behind the curtain at the additional tiers of mortgage lending helps to explain the reasoning behind the process and requirements in place.

Once you understand the flow of money within the mortgage world, and how your personal home loan is only one small piece of a much bigger picture, the strict qualification criteria and documentation requirements make more sense.

So when your loan officer asks you to provide months of bank statements, letters of explanation for the terms of your employment, or proof of residency from two addresses ago, remember that you’re doing it, not just for yourself and your new home, but for Fannie Mae and Freddie Mac and the strength of the American mortgage market.

Additional Resources:

- Mortgage Overlays-Correspondent lenders are the lifeblood of the mortgage industry. Sometimes they get overly cautious about their ability to sell their loans into the secondary market. Luke Skar over at madisonmortgageguys.com explains what overlays are. Now that you understand where the money flows, I think you’ll find this interesting.

- Should I go with a mortgage broker or a bank?– Conor MacEvilly over at MySeattleHomeSearch.com looks at the decision to use a Mortgage Broker or a Bank/Direct Lender. This is a more detailed look into the subject than we were able get to here and a great read.

- Fourteen Ways to Get Your Mortgage Unapproved-Now that you understand the importance of the secondary mortgage market and just how much mortgage lenders depend on it. I think your love this article by Bill Gassett over at MaxRealEstateExposure.com. Bill looks at the classic things homebuyers can do to fumble the ball just before the cross the goal line.

- Why Can’t I Get a Mortgage?– Kyle Hiscock from the RochesterRealEstateBlog.com looks at the top-5 reasons buyers can’t get a mortgage (hint, they all involve not being able to resell the loan into the “Secondary Mortgage Market).