Many homeowners instinctively consider home improvement loans the primary solution when considering a home makeover. However, there might be more advantageous paths waiting to be explored. This article sheds light on alternative financing avenues to help you make savvy home investment decisions without merely following the norm.

While traditional home improvement loans provide the convenience of spreading out expenses over time, it’s essential to be well informed about all available options. Before you dive deep into commitments, we’ll introduce you to eight alternative funding methods tailored to offer better terms or more closely match your needs. Let’s embark on this journey to find the best fit for your home transformation!

1. Home Equity Line of Credit

A HELOC, or Home Equity Line of Credit, is a revolving credit tool that lets homeowners borrow against their home’s equity, using the home as collateral. Unlike traditional loans, it offers flexibility by allowing borrowing up to a set limit as needed, typically with variable interest rates. This adaptability spans a draw period (commonly 5-10 years) before transitioning to the repayment phase.

Advantages:

- Flexibility: Borrow what you need when needed.

- Interest-Only Option: You can pay only the interest during the draw period.

- Potential Tax Benefits: Interest might be tax-deductible for home upgrades. (Consult a tax expert.)

- Often Lower Initial Rates: Compared to some fixed-rate loans.

- Credit Reuse: You can reborrow up to the limit as you pay back.

Disadvantages:

- Rate Fluctuations: The rate can rise, potentially increasing costs.

- Home at Risk: If not repaid, you could face foreclosure.

- Over-Borrowing Temptation: Easy access might lead to borrowing more than needed.

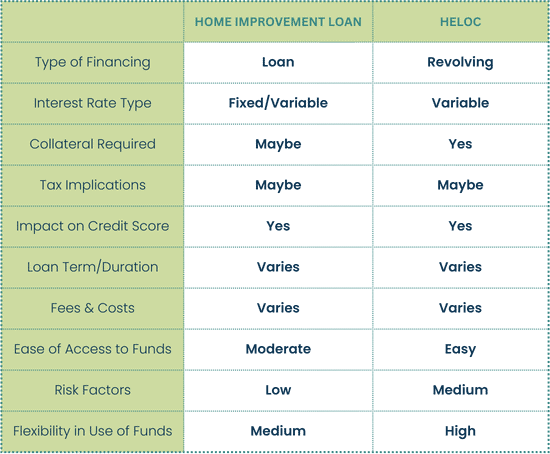

HOME IMPROVEMENT VS. HELOC

Choosing between home equity lines of credit or a standard home improvement loan depends on individual situations and needs.

2. Home Equity Loan or Second Mortgage

Given their shared characteristics, “home equity loan” and “second mortgage” are frequently used synonymously. Nonetheless, important differences exist.

A home equity loan gives a one-time lump sum, typically with a fixed interest rate, ensuring consistent payments. Often used for home renovations, these funds are repaid in predetermined monthly installments, usually spanning 5 to 30 years.

In contrast, a second mortgage refers to any loan secured by a home’s equity while a primary mortgage remains. While all home equity loans are second mortgages, the reverse isn’t true.

Second mortgages can be home equity loans or structures like a Home Equity Line of Credit (HELOC), a flexible credit line. Notably, during foreclosure, primary mortgages are prioritized over second ones, making the latter riskier for lenders and potentially affecting terms.

While both loans use home equity as collateral, their purposes and structures vary. The right option hinges on individual financial needs and goals.

Advantages:

- Fixed Interest Rates: Home equity loans typically come with fixed interest rates, providing predictable monthly payments throughout the life of the loan.

- Lump-Sum Amount: Borrowers receive a one-time lump sum, which can be useful for significant expenses or projects.

- Tax Benefits: The interest paid on a home equity loan might be tax-deductible if the funds are used for home improvement. (However, always consult with a tax advisor.)

- Higher Loan Amounts: Since these loans are based on a home’s equity, homeowners might qualify for larger amounts than unsecured loans.

- Flexible Use of Funds: A home equity loan can be used for various purposes, from home renovations to debt consolidation or major expenses.

Disadvantages:

- Risk to Home: Since the home secures the loan, failure to repay could result in foreclosure.

- Closing Costs: Like with the initial mortgage, a home equity loan might come with closing costs, which can be a significant amount.

- Possible Debt Accumulation: If not managed properly, homeowners might accumulate more debt without improving their financial standing.

- Potential for Decreasing Home Equity: If property values decrease, homeowners could owe more than their home’s worth, leading to negative equity.

- Fixed Payments: Unlike a revolving line of credit, once the lump sum is spent, you can’t borrow more without refinancing or taking out another loan.

- Loan Priority: In the event of a foreclosure, the primary mortgage gets paid off before the second mortgage, which could result in less recovery for the second mortgage holder.

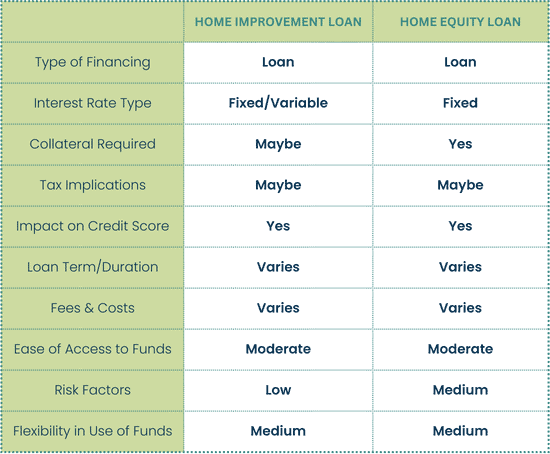

HOME IMPROVEMENT LOAN VS. HOME EQUITY LOAN

3. Hybrid HELOC

A Hybrid HELOC blends the adaptable features of a traditional HELOC with the predictability of a fixed-rate home equity loan. Initially, borrowers can access funds up to a credit limit during a draw period.

Uniquely, after this period, the balance can be converted to a fixed-rate loan rather than directly transitioning to repayment, ensuring stable payments and guarding against rate increases. This product offers flexibility and security, with the home as collateral and potential fees for rate conversions, emphasizing the importance of understanding its terms.

Advantages

- Flexibility: Provides the adaptability of a traditional HELOC, allowing borrowers to draw, repay, and re-borrow funds up to a set credit limit during the draw period.

- Predictable Payments: After the draw period, the ability to convert to a fixed-rate loan offers consistent monthly payments, eliminating surprises from fluctuating interest rates.

- Protection Against Rate Fluctuations: Borrowers can shield themselves from potential interest rate increases by locking in a portion (or all) of the balance at a fixed rate.

- Best of Both Worlds: Combines the advantages of both a HELOC and a fixed-rate home equity loan, granting borrowers a broader range of options.

- Potential for Lower Initial Rates: Initial draw periods offer lower interest rates, which can benefit borrowers.

Disadvantages

- Complexity: The hybrid nature might confuse some borrowers, requiring them to be more attentive to the loan’s terms and conditions.

- Potential Fees: Converting from a variable to a fixed rate might come with associated fees or charges.

- Collateral Risk: As with other home equity products, the borrower’s home is collateral. Failing to keep up with payments could lead to foreclosure.

- Potential for Higher Overall Interest: If market interest rates decrease and the borrower has locked in a higher fixed rate, they might pay more in interest over the life of the loan.

- Less Flexibility Post-Conversion: Once a portion of the HELOC is converted to a fixed rate, it loses the revolving feature, and borrowers can’t re-borrow from that portion.

Understanding the nuances of financial products like hybrid HELOCs can provide a good option for accessing equity in a property.

As with any financial product, the suitability of a Hybrid HELOC depends on individual financial situations, needs, and market conditions. It’s essential to understand all aspects of the loan before committing.

4. Cash-Out Refinance

A cash-out refinance for home improvements allows homeowners to refinance their current mortgage for more than they owe, receiving the difference as a lump sum of cash. This strategy can be especially appealing when a homeowner plans significant renovations or repairs, as it provides the necessary funds to undertake such projects.

However, one of the most crucial aspects to deliberate before diving into a cash-out refinance is the comparison of current mortgage rates to your existing ones. If the prevailing rates are considerably lower than your existing mortgage rates, refinancing could provide funds for improvements and lead to long-term savings through reduced interest payments.

Conversely, if current rates are higher, even the benefit of immediate cash for home improvements might not offset the potential increase in monthly payments or the total interest paid over the life of the loan.

Calculating the long-term implications, not just the immediate influx of cash, is pivotal to ensure that a cash-out refinance is a financially astute decision for your circumstances.

Advantages

- Lower Interest Rates: Typically, a cash-out refinance might offer lower interest rates than other types of loans or credit cards, leading to potential savings over the life of the loan.

- Increased Home Value: Funds used for home improvements can boost the property’s value, potentially offering a higher return on investment when selling.

- Consolidation: By refinancing, homeowners can consolidate their primary mortgage and the cash they take out into a single loan payment, simplifying finances.

- Tax Deductions: The interest on mortgage debt, including debt from a cash-out refinance, may be tax-deductible if used for home improvements, though it’s essential to consult with a tax advisor.

- Longer Repayment Period: Cash-out refinances often come with extended repayment periods, allowing for smaller monthly payments.

- One-Time Large Amount: Provides a significant lump sum, ideal for substantial home improvement projects.

Disadvantages

- Closing Costs: Refinancing a mortgage involves closing costs, which can be substantial. It’s crucial to ensure that the long-term savings outweigh these upfront costs.

- Higher Total Interest: Extending the loan term, even with a lower interest rate, can mean paying more in total interest over the life of the loan.

- Reduced Equity: Homeowners are tapping into their home’s equity, which reduces their overall equity in their property.

- Potential for Higher Monthly Payments: Monthly payments could increase if the new loan balance is significantly higher or if prevailing rates are up since the original mortgage.

- Risk of Foreclosure: As with any mortgage, failing to make payments on a cash-out refinance puts the home at risk of foreclosure.

- Market Value Risk: If the housing market declines, homeowners might owe more on their house than it’s worth after a cash-out refinance.

- Potential for Overcapitalizing: Over-improving a home beyond the value of neighboring properties can lead to difficulties recouping the investment when selling.

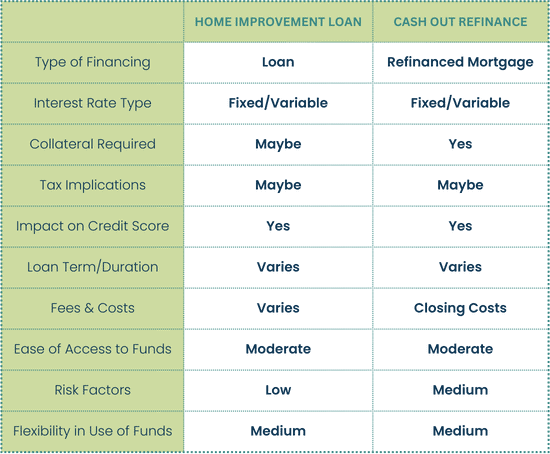

HOME IMPROVEMENT LOAN VS. CASH-OUT REFINANCE

When considering a cash-out refinance for home improvements, it’s essential to weigh the benefits against the potential drawbacks and consult financial professionals to make an informed decision.

5. Borrowing from Retirement Funds

Many retirement plans, such as 401(k)s, allow participants to borrow against their savings for specific purposes, including making home improvements. However, the feasibility and wisdom of doing so depend on various financial and personal factors.

Advantages:

- No Credit Check: Since you’re borrowing your own money, a credit history is not required, making the process potentially smoother.

- Lower Interest Rates: Typically, the interest rate for borrowing from a retirement fund is lower than that of a personal loan or credit card. Additionally, the interest you pay goes back into your retirement account.

- Flexible Repayment Terms: Many plans offer a reasonable repayment period, often up to five years or more if used for purchasing a primary residence.

- No Tax Penalties: If you repay the loan on time and follow the plan’s rules, you won’t incur the 10% early withdrawal penalty or pay income taxes on the borrowed amount.

Disadvantages:

- Lost Investment Growth: By withdrawing funds, even temporarily, you might miss out on potential investment growth, which can affect your long-term retirement savings.

- Repayment Risks: If you fail to repay the loan or leave your job before repaying in full, the outstanding balance can be treated as a distribution. This can result in taxes and penalties.

- Double Taxation: While you repay the loan with after-tax dollars, distributions in retirement are taxed again.

- Reduces Retirement Security: The primary purpose of a retirement fund is to ensure financial security in retirement. Borrowing against it can compromise this goal.

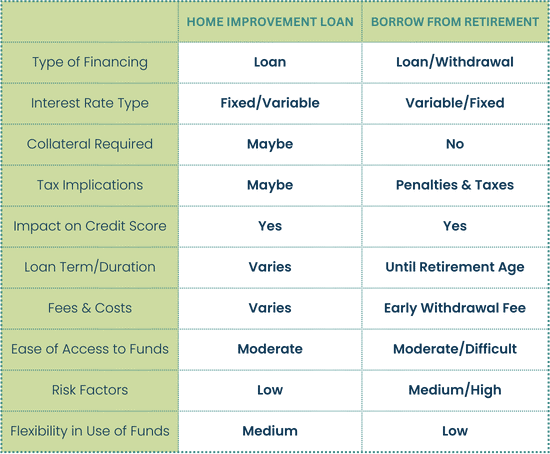

HOME IMPROVEMENT LOAN VS. BORROWING FROM RETIREMENT FUNDS

Whether borrowing from a retirement fund for home improvements is better than taking out a home improvement loan depends on individual circumstances. It’s crucial to weigh the immediate benefits against the long-term impact on retirement savings. It’s always recommended that they consult with a financial advisor to determine the best decision for their situation.

6. P2P Loans

Peer-to-peer (P2P) loans connect individual borrowers with investors directly online, bypassing traditional banks and credit unions. These online platforms vet borrowers, set interest rates, and handle transactions for a fee. P2P loans are versatile, catering to debt consolidation, business needs, and home upgrades.

Borrowers can benefit from flexible terms and the lowest rates with P2P, especially if they have good credit. The online application is quick and ideal for urgent needs like home renovations.

P2P offers potentially higher returns for investors than traditional investments, diversifying portfolios. But there’s more risk; these loans need to be insured. Investors should scrutinize the platform’s risk procedures and spread their investments among multiple borrowers.

Both parties should understand P2P loan specifics and consider consulting financial advisors to ensure it fits their financial needs correctly.

Here are five P2P lenders that commonly offer loans for home improvement purposes:

- LendingClub – LendingClub provides personal loans that can be utilized for various reasons, including home improvement projects. These are unsecured loans, which means you don’t need to use your home as collateral

- Prosper – Prosper is another P2P platform offering personal loans specifically marked for home improvements. The loans are unsecured, so your home is not at risk should you default.

- Upstart – Upstart provides personal loans for multiple purposes, including home improvements. Their unique creditworthiness algorithm can be advantageous for borrowers with different credit histories.

- Peerform – Peerform offers personal loans that can be used for home improvement endeavors. It accommodates a range of credit scores, offering more inclusivity for potential borrowers.

- SoFi – SoFi is a financial services company operating in the P2P lending space. They offer personal loans that can be used for home improvements, and they provide additional perks like unemployment protection.

Advantages:

- Online Platforms: P2P loans are facilitated through online platforms, making the application process often quick and user-friendly.

- Flexible Lending Criteria: P2P lenders might be more willing to approve loans to individuals with less-than-stellar credit histories.

- Fixed Interest Rates: Most P2P loans come with fixed interest rates, providing predictability in monthly payments.

- No Collateral: Many P2P loans are unsecured, so homeowners won’t risk their property if they default.

Disadvantages:

- Potentially Higher Interest Rates: Depending on your credit score, P2P loans have higher interest rates than secured home improvement loans.

- Fees: Some P2P platforms charge origination fees, which can add to the cost of borrowing.

- Limited Loan Amounts: Some P2P platforms have caps on the maximum loan amount, which might not cover extensive home improvement projects.

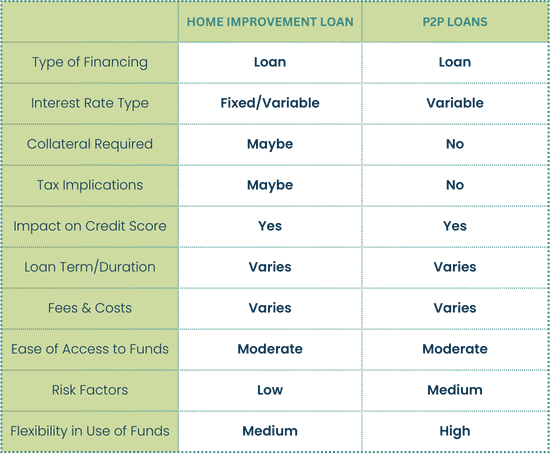

HOME IMPROVEMENT LOAN VS. PEER-TO-PEER LOAN

In today’s evolving financial landscape, P2P lending offers a compelling alternative to traditional lending and borrowing methods. Through user-friendly platforms, P2P loans provide borrowers with a more accessible and flexible way to finance home improvements without using their homes as collateral.

Meanwhile, investors have a unique avenue for diversification and potentially higher returns. However, as with all financial endeavors, there are inherent risks and costs. Borrowers and investors must thoroughly research each platform and its offerings, ensuring they make well-informed decisions.

When utilized judiciously, P2P lending can be an effective tool for home improvements and investment opportunities.

7. Personal Lines of Credit And Personal Loans

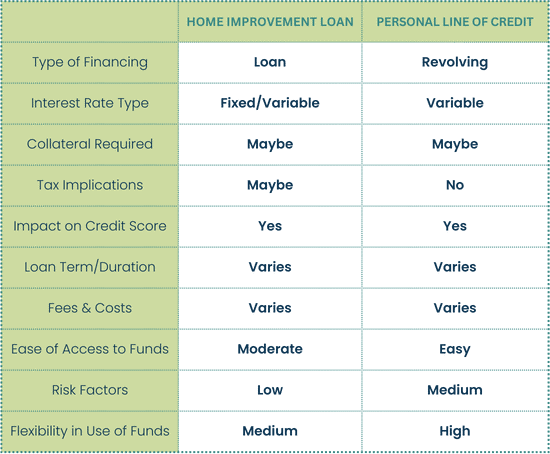

Personal Lines of Credit, Personal Loans, and Home Improvement Loans are popular financing options for homeowners looking to fund home improvement projects. Here’s a comparison of the three advantages and disadvantages:

Personal Line of Credit

Advantages

- Flexibility: Similar to a credit card, you can draw from a personal line of credit up to your credit limit as needed.

- Pay Interest Only on What You Use: You only pay interest on the portion of the credit line you’ve used, not on the entire credit limit.

- Revolving Credit: As you repay, you can reuse the available credit.

Disadvantages

- Higher Interest Rates: Generally have higher interest rates than secured loans, as they’re often unsecured.

- Variable Rates: Many personal lines of credit have variable interest rates, which can lead to fluctuating monthly payments.

- Overdraft Fees: Some lines of credit may have fees if you exceed the credit limit.

Personal Loans

Advantages

- Fixed Payments: Personal loans usually have fixed interest rates, which means consistent monthly payments.

- No Collateral: They are often unsecured, so you don’t risk an asset like your home.

- Quick Approval: Unsecured personal loans are usually approved faster than home equity products.

Disadvantages

- Higher Interest Rates: Since they’re often unsecured, personal loans typically have higher interest rates than home improvement loans or home equity loans.

- Fixed Loan Amount: Once you get the loan, you can’t increase the amount if you need more funds.

- Origination Fees: Some lenders charge an origination fee.

HOME IMPROVEMENT LOAN VS. PERSONAL LINE OF CREDIT

8. FHA Property Improvement Loans

If you want to use an FHA loan for home improvements, consider the FHA 203(k) loan program. This program is specifically designed to help individuals renovate or repair their homes. The FHA 203(k) program allows homeowners to finance a house’s purchase (or refinancing) and the cost of its rehabilitation through a single mortgage.

The FHA 203K loan is a unique mortgage product designed to finance a home’s purchase and its renovation costs. It comes in two types: the Standard 203K for major structural repairs and the Limited 203K for minor, non-structural updates, capped typically at $35,000. With a low down payment requirement of just 3.5%, this loan is suitable for one- to four-family homes that have been completed for at least a year. The loan amount is based on the post-renovation home value or the combined purchase and renovation costs, whichever is less.

Renovations must start within 30 days of closing and finish within six months. While it offers flexibility in improving a property, it requires oversight with selected contractors approved by the lender and may come with slightly higher interest rates than standard FHA loans.

Types of FHA 203(k) Loans:

- Standard 203(k) Loan: This is for more significant rehabilitation projects that cost more than $35,000 or require structural modifications, such as room additions or foundation repairs.

- Limited 203(k) Loan (formerly known as Streamlined 203(k)): Designed for minor remodeling and non-structural repairs. There’s a cap of $35,000 on repair and improvement costs.

Eligible Improvements:

- Repairs and remodeling

- Room additions

- Landscaping

- Plumbing, electrical, and HVAC systems

- Roof, gutter, and downspout repairs

- Flooring, tiling, and carpeting

- Energy conservation improvements

Advantages:

- Combined Financing: Allows borrowers to finance both the purchase and renovation of a home with a single loan.

- Low Down Payment: Requires as little as 3.5% down, making it more accessible to many homebuyers.

- Increase Home Value: This enables you to purchase fixer-uppers and increase the value of your home through renovations.

- Flexible Property Requirements: Suitable for homes in need of minor to major repairs, including structural changes.

- Favorable Interest Rates: Often comes with competitive interest rates compared to other home renovation loan options.

- Expand Home Choices: Broadens the scope of properties a homebuyer might consider, including distressed or outdated properties.

- Safety and Health Upgrades: The loan can cover necessary safety or health-related improvements to the property.

- Loan Security: The loan is backed by the federal government, which can offer added security to lenders.

Disadvantages:

- Complexity: The process involves more steps than a standard mortgage, including property evaluations and oversight of renovations.

- Higher Interest Rates: Might have slightly higher rates than standard FHA loans due to the increased risk associated with property renovations.

- Mortgage Insurance: Borrowers must pay an upfront and annual mortgage insurance premium, adding to the cost of the loan.

- Contractor Limitations: Approved contractors must carry out renovations, limiting the borrower’s choices.

- Lengthy Approval Process: Due to its complexity, securing an FHA 203K loan might take longer than other types of loans.

- Additional Fees: These can come with added fees or higher costs related to inspections, title updates, and architectural services.

- Renovation Restrictions: Not all renovations are allowed, and luxury improvements are typically excluded.

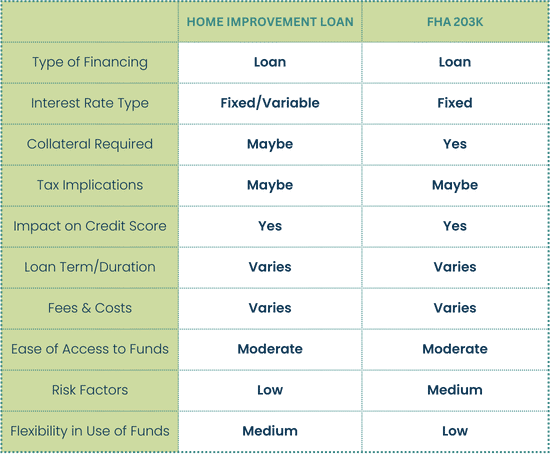

HOME IMPROVEMENT LOAN VS. FHA 203K

The FHA 203(k) loan is a specialized program for those looking to buy and renovate a home with a single mortgage.

The Standard 203(k) is offered in two versions for larger projects, while the Limited 203(k) covers minor renovations up to $35,000. With a modest 3.5% down payment, this loan is an attractive option for many, making home renovations more accessible.

However, it’s essential to note that the process can be complex, often requiring approved contractors and potentially involving extra fees. As such, potential borrowers should evaluate if its advantages align with their needs before diving in.

9. Local, State, and Federal Government Loans

Across the country, many programs are ready to help homeowners spruce up their homes, tackle repairs, or make big upgrades. Agencies like the U.S. Department of Housing and Urban Development (HUD) and the USDA have set up programs to make homes safer and more comfortable. They’re especially keen on helping out folks with limited incomes.

It’s not just at the national level; many state and local programs are also stepping up, ensuring homeowners everywhere get a hand in improving their homes. So, if you’re thinking of home improvements, it’s worth checking out what help might be available!

Here’s a list of national home improvement and rehabilitation programs sponsored by the federal government or a federal agency:

Federal Resources

- FHA 203(k) Rehabilitation Loan: Sponsored by the Federal Housing Administration (FHA), this loan allows homeowners to finance the purchase and renovation of a home with a single mortgage.

- Fannie Mae HomeStyle Renovation Loan: The Fannie Mae HomeStyle Renovation Loan is a mortgage product that allows borrowers to finance both the purchase or refinance of a home and the cost of its rehabilitation through a single mortgage

- HUD Title I Property Improvement Loan: A program by the U.S. Department of Housing and Urban Development (HUD) that provides loans to homeowners for home improvements and repairs.

- USDA Section 504 Home Repair Program: Also known as the Single Family Housing Repair Loans & Grants, this U.S. Department of Agriculture (USDA) program provides loans to low-income homeowners for repairs and improvements. Additionally, it offers grants to elderly, very-low-income homeowners to address health and safety hazards.

- VA Renovation Loan: A loan program by the Department of Veterans Affairs (VA) that allows veterans to finance both the purchase and rehabilitation of a home.

- Weatherization Assistance Program (WAP): Sponsored by the Department of Energy, WAP helps low-income households reduce energy costs by improving their homes’ energy efficiency.

- HOME Investment Partnerships Program: This HUD program provides grants to states and localities that can be used for building, buying, and rehabilitating affordable housing for rent or homeownership.

- Indian Housing Block Grant: Managed by HUD, this grant aids in developing and operating low-income housing on tribal lands.

- Elderly and Persons with Disabilities Program: A HUD initiative offering home modifications grants to enhance accessibility.

- Energy Efficient Mortgage Program: An initiative by the FHA that allows homeowners to finance energy-efficient improvements alongside their home purchase or refinance.

State & Local Resources

Colorado Springs and El Paso County offer a variety of programs designed to assist homeowners, particularly the elderly and low-income families, with home maintenance, repairs, and upgrades.

- Colorado Springs Housing Rehabilitation Program: This program targets low-income homeowners and offers financial assistance for critical repairs such as heating systems, plumbing, and electrical work. It aims to improve living conditions and increase home safety.

- Colorado Springs Affordable Homeownership Program: While not directly a home improvement program, this initiative helps low-income families afford homes, which could indirectly give them the means for future home improvements.

- El Paso County Housing Authority’s Single-Family Rehabilitation Loan Program: This program provides low-interest loans for home improvements. Projects can range from necessary repairs like roof replacement to upgrades like installing energy-efficient appliances.

- Weatherization Program: This El Paso County program aims to help low-income homeowners reduce energy costs by improving home energy efficiency. This could include insulation upgrades, window replacements, and even some renewable energy installations.

- Colorado State Housing Assistance Programs: Managed by the Colorado Housing and Finance Authority (CHFA), it provides various resources, including loans and grants for home repairs and improvements.

- Weatherization Assistance Program (Colorado): Aimed at helping low-income families reduce their energy bills by making their homes more energy-efficient. This might include insulation, sealing off drafts, and upgrading heating and cooling systems.

- Home Modification Tax Credit: Offered to Colorado homeowners to make accessibility modifications to their homes, making it easier for elderly or disabled family members to live in the residence.

- Safe at Home Colorado: This program provides financial assistance to individuals with disabilities to make accessibility modifications, ensuring they can safely live in their homes.

- Colorado Foreclosure Hotline: While primarily a counseling service, they also guide homeowners to potential resources and grants to assist with home maintenance and avoid foreclosure.

- Rehabilitation and Acquisition Program: Some local Colorado governments and housing authorities offer programs designed to rehabilitate or acquire substandard properties. These programs aim to bring such properties up to safety and health standards.

- Water Conservation Programs: Given Colorado’s unique climate and environment, several local agencies and municipalities offer incentives or rebates for homeowners undertaking water conservation measures in their homes or gardens.

Here are the advantages and disadvantages of using national home improvement and rehabilitation programs sponsored by the federal government or a federal agency:

Advantages:

- Financial Assistance: Many of these programs offer loans with favorable terms, grants, or a combination of both, making home improvement more affordable for homeowners.

- Accessibility: Programs often cater to specific segments, such as veterans, the elderly, or very low-income individuals, addressing the unique needs of these groups.

- Increases Home Value: Proper home rehabilitation can enhance the value and longevity of the property.

- Energy Efficiency: Some programs emphasize energy efficiency, leading to long-term savings on utility bills.

- Safety and Health: Grants and loans focused on health and safety ensure homeowners can rectify hazardous conditions in their homes.

- Streamlined Process: These government-backed initiatives may offer a more streamlined application and approval process than private loans.

- Economic Boost: By promoting home rehabilitation, these programs indirectly boost the housing market and related industries, such as construction.

Disadvantages:

- Eligibility Criteria: Not everyone will qualify. Programs often have strict eligibility criteria based on income, location, or property type.

- Bureaucratic Delays: Being government initiatives, there can sometimes be bureaucratic red tape leading to potential delays in funding or project approvals.

- Loan Debt: Even with favorable terms, borrowing for home improvements adds to a homeowner’s overall debt load.

- Limited Funds: Some programs have limited funds and can run out of grants or loans before all qualified applicants receive assistance.

- Property Liens: In some cases, if grants or loans are not repaid or terms are not met, the government agency might place a lien on the property.

- Long-term Commitments: Some programs might require homeowners to stay in their homes for a specific period post-renovation, limiting mobility.

- Complexity: Navigating through the myriad of programs, understanding each one’s specifics, and gathering required documentation can be overwhelming for some homeowners.

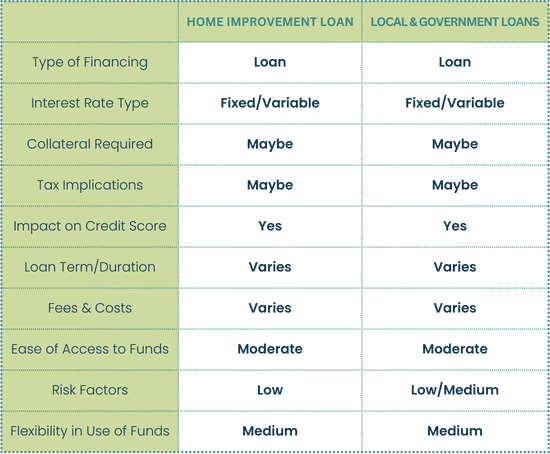

HOME IMPROVEMENT LOAN VS. LOCAL, STATE, AND FEDERAL LOANS

When considering these programs, it’s crucial for homeowners to thoroughly research and consult with a housing counselor or financial advisor to ensure they’re making informed decisions.

10. Personal Savings

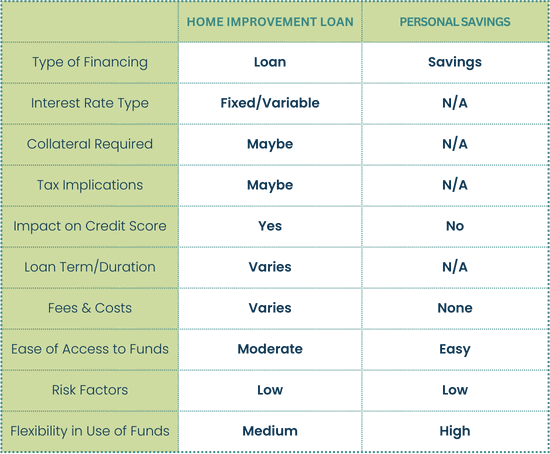

Using personal savings to fund home improvements offers several advantages, the most significant of which is avoiding interest charges. Unlike loans or credit cards that can have substantial interest rates, using your own savings allows you to sidestep this added cost.

The money you save on interest can be substantial, depending on the size and duration of the loan you would have taken. Using savings translates to a direct reduction in the overall cost of the home improvement project, potentially making it more affordable and freeing up funds for additional enhancements or other financial goals.

Another advantage of using personal savings is its flexibility and speed. Since you’re not borrowing money, there are no approval processes, credit checks, or waiting periods.

You have immediate access to your funds, allowing you to start your home improvement project immediately. This can be especially beneficial in urgent situations, such as emergency repairs, where time is of the essence.

Moreover, the absence of monthly loan payments provides greater financial freedom, alleviating the stress of meeting payment deadlines and maintaining cash flow. This can offer you peace of mind, knowing that your project is fully paid for and won’t result in future financial burdens.

HOME IMPROVEMENT LOAN VS. PERSONAL SAVINGS

Finally

In navigating the intricate landscape of home improvement and rehabilitation financing, homeowners are presented with diverse options, from federal programs to those specific to Colorado.

Each avenue offers unique advantages tailored to meet varied needs and circumstances. However, the responsibility to make informed decisions comes with this abundance of choices. It’s paramount to consult with a financial expert who can guide you toward the most beneficial financial product for your situation.

Similarly, a seasoned real estate professional can provide insights into your property’s most value-adding home improvements. With the right knowledge and expert advice, you can confidently embark on your home improvement journey, ensuring your efforts are financially sound and value-enhancing.