"What's my home worth?" It's the first question nearly every homeowner asks when they find out I'm a REALTOR®. Honestly, I get it. There's something irresistible about knowing whether you've made money on what's probably your biggest investment. It's that little dopamine hit—finding out your $350,000 purchase from 2019 is now worth $480,000. You've probably already checked Zillow just to see the number. Maybe you've watched your neighbor's house sell and done some mental math. You might have even noticed that new listing down the street and thought, "Wait, they're asking how much?"

Here's the thing: figuring out what your home is worth isn't quite as simple as plugging your address into a website. Zillow will give you a number—and it's a decent starting point—but that algorithm doesn't know that you just replaced your roof, that your backyard backs to open space, or that the house it's comparing you to has a finished basement while yours doesn't. It can't account for hidden fees like metro district assessments or HOA dues that dramatically affect a buyer's monthly payment, or that military buyers near Peterson and Carson have different priorities and timelines than civilian buyers.

Selling your House is a huge financial transaction, so "close enough" can cost you. Overprice by even 5%, and you'll sit on the market watching other homes sell while yours goes stale. Underprice, and you're leaving tens of thousands of dollars on the table. Get it right, and you'll sell quickly, for top dollar, with minimal stress.

So how do we get it right? That's where a professional Comparative Market Analysis comes in—not an algorithm's best guess, but a detailed, line-by-line analysis that looks at real comparable sales and makes specific adjustments for every difference between your home and what's actually selling in your neighborhood. Let me walk you through exactly how we do it.

How We Determine Your Home's True Value

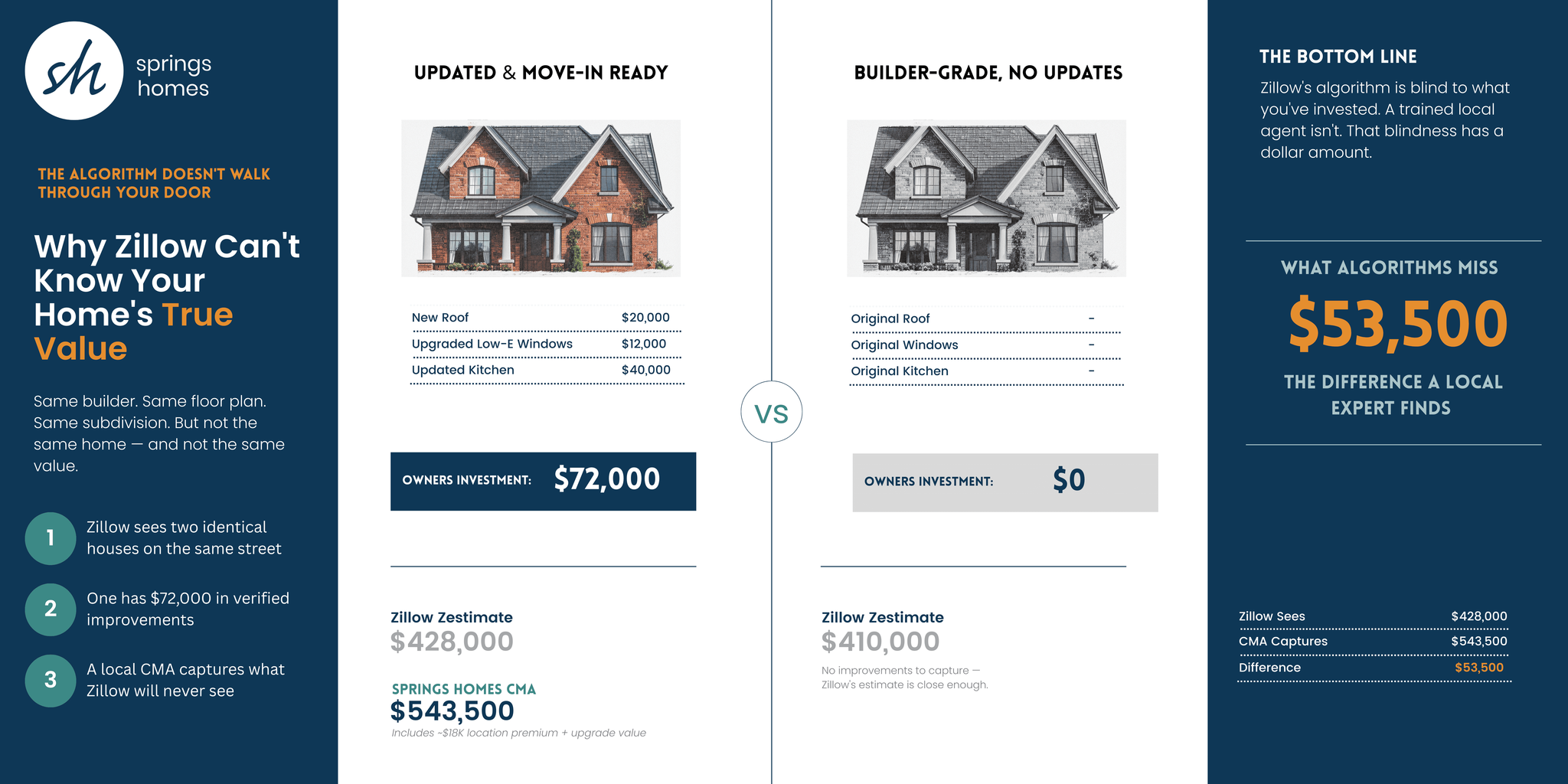

We start by finding homes that are genuinely comparable to yours — same builder, same floor plan, same subdivision. In this example, we're looking at two homes on the same street built from the identical blueprint. Zillow sees them as essentially the same, and its Zestimate reflects that: $428,000 for one, $410,000 for the other. An $18,000 gap for what the algorithm assumes is just a location difference.

But here's what the algorithm can't see.

One of these homes has a new roof, upgraded low-E windows, and a fully renovated kitchen — $72,000 in owner investment. The other is still in original builder-grade condition, with $0 in improvements. Those aren't cosmetic differences. They're real, documentable value that buyers will pay for.

That's where the debits and credits method comes in. We're asking: "If these homes are otherwise identical, how much is each improvement worth to a buyer in today's market?" A new roof isn't just an aesthetic upgrade — it removes a major buyer concern and a likely negotiation point. Low-E windows reduce utility costs. A renovated kitchen changes how a home shows and what buyers are willing to offer.

When we apply those adjustments to the comparable sale data, the updated home's true market value isn't $428,000 — it's $543,500. That's a $53,500 difference that Zillow's algorithm will never find, because an algorithm can't walk through your front door.

That $53,500 is what a professional CMA does. It's the difference between pricing your home on what a computer assumes and pricing it on what your home has actually become.

Why These Adjustments Aren't Just Made Up

You might be wondering: where do these adjustment amounts come from? Is there some official price list somewhere that says a finished basement is worth exactly $30,000 or a new roof adds exactly $10,000?

Here's what might surprise you: there isn't. And that's actually by design.

Fannie Mae—the government-sponsored entity that sets the standards for most residential appraisals in the United States—explicitly states that there are "no specific limitations or guidelines associated with net or gross adjustments." They go further, saying it's "not acceptable to use a rule-of-thumb $20 per square foot adjustment" when actual market analysis shows something different.

Instead, Fannie Mae requires that every adjustment must be market-derived. That means an appraiser (or a skilled real estate agent doing a CMA) must analyze what buyers in that specific market are actually willing to pay for specific features. Not what a national average suggests. Not what worked in Denver or Phoenix. What buyers in your neighborhood, in Colorado Springs, right now, are demonstrating through their purchase decisions.

This is why two finished basements in different neighborhoods might have completely different values. A finished 800-square-foot basement in an older neighborhood near downtown might add $15,000 to your home's value, while the same finished basement in a newer subdivision in Banning Lewis Ranch might add $20,000—simply because buyers in those markets value that feature differently.

The adjustments change based on:

- Location: Buyers in different Colorado Springs neighborhoods value features differently

- Price point: A $300,000 home and a $700,000 home don't adjust the same way

- Current market conditions: What features commanded a premium six months ago might not today

- Supply and demand: When inventory is tight, certain features become more valuable

This is exactly why professional market analysis matters and why Zillow's algorithm can't accurately price your home. We're not pulling numbers from a book or using generic formulas. We're analyzing what actual buyers in your specific market are paying right now for homes with features similar to yours.

"To give you a sense of what we're analyzing, here are typical adjustment ranges we're seeing in the Colorado Springs market right now:"

Here's the critical part most sellers don't think about: We're not just pulling numbers out of thin air with this method—we're using the exact same approach an appraiser will use when the buyer's lender orders an appraisal. Your home actually sells twice, once to the buyer and then to the appraiser. The appraisal process is vital to getting the home sold, unless of course you have a cash buyer. And here's why that matters: if your home doesn't appraise at the contract price, you've got problems. The buyer's lender won't loan more than the appraised value, which means either the buyer needs to bring extra cash to close, you need to lower your price, or the deal falls apart entirely.

So we begin with the end in mind. Our job is to push your listing price as high as the market will support—maximizing your net proceeds—while making absolutely certain the home will appraise when it matters. We're walking a strategic line: aggressive enough to get you top dollar, but defensible enough that an appraiser looking at the same comparable sales will arrive at the same conclusion we did. That's the difference between a home that sells quickly at a great price versus one that goes under contract only to fall apart three weeks later at the appraisal.

Understanding Colorado Springs' Market in 2026

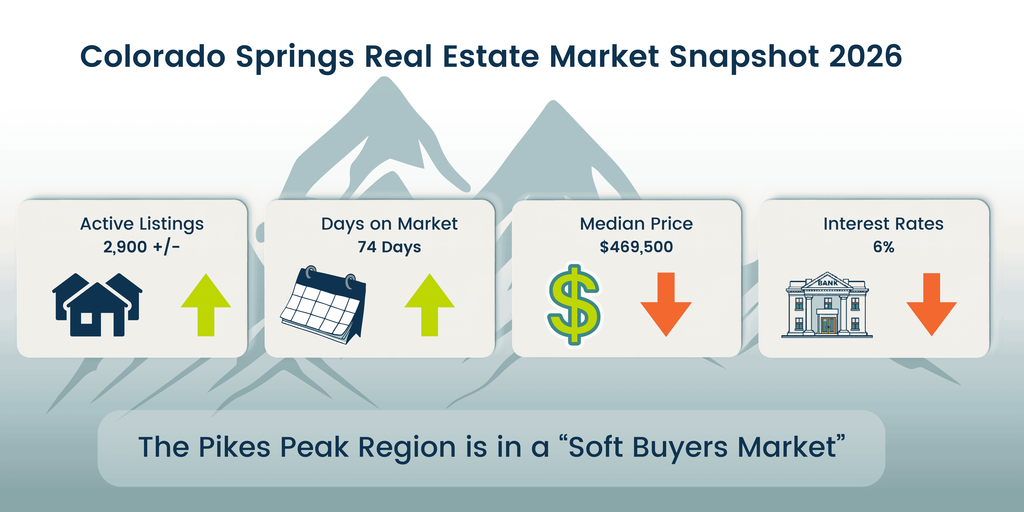

Let's talk about where we are right now, because context matters. The Colorado Springs market has cooled significantly from the frenzy of 2021-2022. We're starting 2026 with the highest inventory we've seen since 2013—nearly 2,900 homes for sale in January—and sales are down about 9% from last year. The median price has dipped slightly to around $469,500, and homes are taking an average of 74 days to sell, rather than disappearing in a weekend. Many buyers expected interest rates to drop substantially in 2026, but they've stubbornly held around 6%, which is still double what it was just a few years ago. Add to that the government spending freeze that hit Colorado Springs particularly hard given our heavy concentration of federal employees and contractors, and you have a market where buyers have options and sellers need to be strategic.

Here's the reality: we're in a soft buyer's market. That doesn't mean prices are crashing—they're not. But it does mean that competitive pricing is more important than it's been in the last decade. Overpriced homes sit. Well-priced homes with strong presentation still move. The days of throwing a house on the market at any price and getting multiple offers are over. In 2026, precision matters. It's important to note that a CMA is different than an appraisal. But, an accurate CMA isn't just helpful—it's essential to getting your home sold without leaving money on the table or watching it go stale on the market.

Why Professional Analysis Matters

Here's the uncomfortable truth that most sellers don't want to hear: 77% of real estate agents identify overpricing as the number-one mistake homeowners make in today's market. And it's costly—studies consistently show that overpriced homes end up selling for 5-10% less than homes that were priced correctly from the start.

Think about that. A $500,000 home overpriced by just 5% could cost you $25,000 to $50,000 in lost equity. Not because the market crashed, but because you missed the window when buyers were most interested.

The First Two Weeks Are Everything

When your home first hits the market, it's fresh. Buyers who've been searching for months suddenly have a new option to consider. Their agents send alerts. Online algorithms push your listing to the top. You get maximum exposure and maximum interest.

But here's what happens when you overprice: those buyers look at your listing, compare it to similar homes they've already seen, and move on. The data is clear—homes priced correctly from day one sell 50% faster than homes that start too high. You don't get a second chance at that critical first impression.

The Stale Listing Stigma

Once your home has been on the market for 30, 60, 90 days, buyers start asking questions. "What's wrong with it?" "Why hasn't it sold?" Even if the only problem was the price, you've now created a perception problem that's hard to shake. In fall 2025, more than half of homes for sale nationwide (54.5%) sat on the market for at least 60 days without finding a buyer—and nearly half of all listings required price cuts, with the median reduction being 4%.

By the time you finally drop the price, you're not just competing with other homes—you're competing with buyer skepticism. And those buyers who do show up? They're the ones who smell desperation and submit lowball offers.

The Appraisal Reality Check

Remember what we talked about earlier: even if you find a buyer willing to pay your inflated price, the appraisal has to support it. If it doesn't, you're back to square one—except now you've wasted weeks or months, lost your best potential buyers, and still have to drop your price.

The Bottom Line: Data + Expertise + Timing

Pricing a home is both art and science. It requires current market data, deep local knowledge, and an understanding of buyer psychology. It means knowing that homes in Cordera with metro district fees need to be priced differently than similar homes in established neighborhoods. It means understanding that military buyers near Peterson and Carson have different timelines and priorities than civilian buyers. It means recognizing when the market is shifting and adjusting strategy accordingly.

Zillow is great for curiosity—for that little dopamine hit of seeing what your home might be worth. But when you're ready to actually sell, when you need precision that protects your equity and gets you to closing, that's when you need a professional Comparative Market Analysis.

Let's Talk About Your Home's Value

We offer free, no-obligation CMAs that typically take about 30 minutes. Here's what you can expect:

- A detailed analysis of recent sales in your neighborhood

- Specific adjustments for your home's unique features and condition

- A strategic pricing recommendation designed to maximize your net proceeds while ensuring the home appraises

- An honest conversation about current market conditions and timing

This isn't a sales pitch. It's about giving you the data you need to make an informed decision. Some sellers aren't ready to list right away—and that's fine. But knowing what your home is actually worth, backed by real comparable sales and professional analysis, is valuable information whether you're selling next month or next year.

Ready to find out what your home is really worth? Contact us today to schedule your free CMA consultation.